Payment Processing

The Legal Responsibilities of Credit Card Processing

Wading through the legal complexities of credit card processing reveals crucial responsibilities for safeguarding sensitive data and ensuring compliance.

In credit card processing, legal responsibilities are crucial. Adhering to the PCI Data Security Standard ensures the safety of cardholder data. Non-compliance can lead to substantial fines for failing to protect customer data. It is vital to maintain PCI compliance for trust and security. The level of compliance varies depending on transaction volume, demonstrating a commitment to data security. Mitigating risks and safeguarding data are top priorities. The credit card processing industry is regulated by various entities, influencing its operations. Following EFTA Regulations for debit cards and state laws enhances data security even further. Understanding and fulfilling these responsibilities effectively protects sensitive data and reduces risks.

Key Takeaways

- Compliance with PCI DSS standards is a legal responsibility.

- Adhering to card association regulations is mandatory.

- Following state laws on credit card processing is crucial.

- EFTA and Debit Card Liability govern debit card responsibilities.

- IRS mandates reporting yearly gross transactions for compliance.

PCI Data Security Standard Overview

In protecting cardholder data during online payment transactions, the PCI Data Security Standard (PCI DSS) plays an indispensable role. The Payment Card Industry (PCI) has established the PCI DSS to guarantee the security of cardholder data environments (CDE).

Overseen by the PCI Security Standards Council, compliance with the Data Security Standard is vital for safeguarding both customers and businesses from data breaches and fraudulent activities. Non-compliance with PCI standards can lead to severe consequences, including hefty fines of up to $100,000 per month.

Businesses that process card payments must adhere to the specific requirements and guidelines outlined by PCI DSS to enhance data security measures effectively. By implementing the PCI standards, organizations can create a secure environment for online transactions, mitigating risks and maintaining trust with their customers.

Understanding and following the PCI DSS is paramount for achieving and maintaining a high level of data security in the realm of online payments.

Importance of PCI Compliance

PCI compliance is essential for businesses handling credit card transactions to safeguard customer data, prevent financial risks, and bolster cybersecurity measures. Failure to meet PCI standards can result in hefty fines, underscoring the necessity of following regulations closely.

Understanding data security standards, compliance requirements, and the risks associated with non-compliance is paramount for businesses in the credit card processing industry.

Data Security Standards

Adopting stringent data security standards like PCI compliance is essential for businesses processing credit card transactions online. The Payment Card Industry Data Security Standard (PCI DSS) safeguards cardholder data in online payments. Non-compliance with PCI standards can result in fines of up to $100,000 per month, making adherence vital.

Businesses handling credit card transactions must comply with the 12 PCI standards to guarantee data security. PCI compliance levels range from Level 1 (processing over 6 million payments yearly) to Level 4 (up to 20,000 payments yearly via ecommerce). Understanding and implementing these standards is mandatory for merchants to protect cardholder information and maintain the integrity of online transactions.

Compliance with PCI DSS demonstrates a commitment to data security and builds trust with customers.

Compliance Requirements Overview

Ensuring adherence to PCI standards is vital for businesses processing card payments to safeguard customer data and prevent financial losses. PCI compliance is mandatory to protect cardholder data within the cardholder data environment.

Compliance levels, ranging from 1 to 4, are determined by transaction volume, with varying reporting obligations based on the number of transactions processed. Organizations must undergo regular audits to maintain PCI compliance.

It's important to note that outsourcing to third-party vendors doesn't absolve businesses of their liability to uphold a secure environment. Failure to comply with PCI standards can lead to significant fines, underscoring the importance of meeting reporting obligations and transitioning to version 4.0 by September 2023.

Risk of Non-Compliance

Maintaining compliance with payment card industry standards is essential for businesses to mitigate financial risks and safeguard customer data. Non-compliance with PCI standards can lead to fines of up to $100,000 per month, highlighting the critical nature of adhering to these regulations.

By protecting cardholder data, businesses not only build trust with customers but also prevent financial losses and enhance cybersecurity measures. Adherence to PCI standards is mandatory for organizations handling credit card transactions to ensure the security and integrity of cardholder information.

Regular audits and assessments play a significant role in maintaining PCI compliance, helping businesses avoid costly data breaches and legal risks. Overall, prioritizing PCI compliance is important for businesses to operate securely and protect sensitive information effectively.

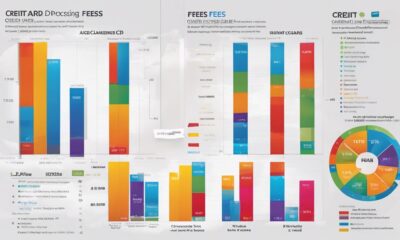

Levels of PCI Compliance

When considering levels of PCI compliance, businesses must adhere to specific standards based on their annual transaction volume. There are four levels of PCI compliance, ranging from Level 1 for businesses processing over 6 million payments annually to Level 4 for those handling up to 20,000 payments through ecommerce.

Adherence to PCI DSS standards is essential for businesses to safeguard cardholder data and prevent fraudulent activities. Entities managing between 20,000 and 1 million ecommerce transactions fall under Level 3 PCI compliance requirements. Non-compliance with these standards can lead to severe penalties of up to $100,000 per month and jeopardize customer data security significantly.

To guarantee PCI compliance, businesses need to engage in continuous assessment, remediation, and reporting processes tailored to their specific level of transactions processed. Upholding PCI compliance not only mitigates risks but also fosters trust with customers by demonstrating a commitment to data security.

Managing PCI Compliance

To effectively manage PCI compliance, businesses must prioritize continuous evaluation and proactive remediation processes. Adhering to PCI DSS standards, which consist of 12 key requirements, is vital for safeguarding cardholder data in online payments. Non-compliance can result in significant fines, underscoring the importance of meeting these regulations.

Compliance levels, categorized from Level 1 to Level 4 based on transaction volume, determine the specific requirements for businesses. Managing PCI compliance involves an ongoing 3-step approach: Evaluating the current state of security measures, remediating any vulnerabilities, and reporting compliance status.

Small businesses, although facing challenges in achieving PCI compliance, can simplify the process by utilizing payment service providers that are PCI-compliant. It's important to recognize that PCI compliance isn't a one-time task but rather an ongoing commitment to maintaining the security of payment card data. By integrating these practices into daily operations, businesses can enhance security measures and mitigate risks effectively.

Additional Credit Card Regulators

Regulating entities beyond PCI DSS, such as the Card Association Network and Nacha, play vital roles in overseeing credit card processing standards and practices. The Card Association Network, represented by major players like Visa and MasterCard, sets forth guidelines to guarantee secure and efficient credit card transactions. Nacha, also known as the National Automated Clearing House Association, focuses on regulating ACH transactions in e-commerce businesses, emphasizing the importance of secure electronic payments.

Additionally, U.S. government regulations, including the Durbin Amendment and IRS reporting requirements, impact credit card transactions by imposing specific rules and reporting obligations on businesses. Compliance with Nacha's Supplementing Data Security Rule is essential for encrypting ACH transaction data, enhancing security measures in the processing of electronic payments.

To fulfill their legal responsibilities in credit card processing, businesses must adhere not only to PCI DSS but also to the standards set by the Card Association Network, Nacha, and various government entities overseeing credit card transactions.

EFTA Compliance for Debit Cards

EFTA regulations outline the guidelines for debit card transactions in the U.S., covering aspects like consumer protection and disclosure requirements.

Understanding debit card liability and the dispute resolution process is essential for businesses to comply with EFTA and protect consumers' rights.

Adhering to these regulations guarantees legal compliance and safeguards against unauthorized transactions when processing debit card payments.

EFTA Regulations Overview

Ensuring compliance with the Electronic Funds Transfer Act (EFTA) regulations is crucial for businesses that process debit card payments to protect consumers and avoid legal repercussions.

EFTA governs debit card transactions, providing essential consumer protections and setting liability limits for unauthorized transactions.

Additionally, EFTA mandates clear disclosure terms and conditions for electronic fund transfers, ensuring transparency and understanding for consumers.

Non-compliance with EFTA requirements can result in severe legal consequences for businesses processing debit card payments, emphasizing the importance of adhering to the established regulations to safeguard both consumers and the business entity.

Debit Card Liability

Complying with debit card liability regulations under the Electronic Funds Transfer Act (EFTA) is vital for businesses processing debit card payments to protect consumers and maintain legal compliance. EFTA regulations govern debit card transactions, outlining the responsibilities of businesses handling debit card payments and ensuring consumer protections.

These regulations establish procedures for resolving errors and addressing unauthorized transactions on debit cards. Understanding and adhering to EFTA compliance is essential for businesses to operate ethically and avoid potential legal liabilities.

Dispute Resolution Process

We must comprehend the significance of adhering to a clear dispute resolution process for debit card transactions as mandated by the Electronic Funds Transfer Act (EFTA). EFTA regulations guarantee consumer protection by providing specific guidelines for handling unauthorized transactions on debit cards.

To comply effectively with EFTA requirements, we need to:

- Respond promptly to reports of unauthorized transactions within the 60-day timeframe specified by EFTA.

- Investigate debit card transaction disputes thoroughly to determine the validity of the consumer's claim.

- Provide provisional credit to consumers during the investigation period, as mandated by EFTA, to prevent financial hardship.

Adhering to the EFTA's dispute resolution process not only safeguards consumers but also fosters trust in the fairness of resolving debit card transaction issues.

Durbin Amendment Requirements

The implementation of the Durbin Amendment in 2010 greatly altered the landscape of interchange fees for debit card transactions. This legislative change aimed to lower interchange fees, impacting how businesses process debit card transactions.

Additionally, the IRS Mandate, specifically Section 6050W, requires merchants to report yearly gross transactions conducted through credit, debit, or co-branded cards. Adhering to the Durbin Amendment and Section 6050W is essential for businesses engaged in credit card processing.

Meeting these compliance requirements is important, as they dictate how merchants handle card transactions and report sales to the IRS. Understanding and fulfilling these obligations constitute significant legal responsibilities for businesses processing credit card payments.

Ensuring compliance with the Durbin Amendment requirements and IRS reporting regulations is necessary for operating within the bounds of the law and avoiding potential penalties. It's imperative for businesses to stay informed about these regulations to navigate the complexities of credit card processing effectively.

IRS Mandate for Payment Processing

The implementation of the Durbin Amendment in 2010 reshaped the landscape of debit card transactions, leading to significant changes in interchange fees. This shift in fees directly intersects with the IRS Mandate for Payment Processing, which mandates that merchants annually report their gross transactions involving credit, debit, or co-branded cards.

- IRS Mandate Requirement: Merchants are obligated to report yearly gross transactions processed with credit, debit, or co-branded cards to comply with Section 6050W of the Dodd-Frank law.

- Comprehensive Reporting: The mandate guarantees transparency and accurate reporting of all types of card transactions processed by merchants, aiding in tax compliance.

- Data Security Standards: Compliance with the IRS Mandate aligns with PCI Data Security Standards, promoting secure handling of card transaction data by credit card processing companies and merchant services providers.

Adhering to the IRS Mandate not only fulfills legal requirements but also contributes to maintaining the integrity of card transaction reporting, benefiting both merchants and the IRS.

State Laws Impacting Credit Card Processing

State laws play a significant role in shaping the landscape of credit card processing by imposing regulations that impact how merchants conduct transactions. For instance, some states like California and Massachusetts prohibit merchants from imposing surcharges on credit card transactions.

In Connecticut, merchants are required to disclose credit card transaction fees to customers before finalizing a sale. These state-specific laws often focus on pricing transparency to safeguard consumers from hidden fees commonly associated with credit card transactions.

Ensuring compliance with these state regulations is essential for businesses as it helps them avoid legal penalties and maintain transparency in credit card processing. Understanding the nuances of state laws can assist businesses in maneuvering the intricate web of credit card processing regulations that vary across different regions, ultimately promoting consumer protection and fair practices in credit card transactions.

Frequently Asked Questions

Which of the Following Law or Standards Deals With Processing Credit Cards?

When it comes to processing credit cards, the Payment Card Industry Data Security Standard (PCI DSS) is the critical law that deals with ensuring the security of cardholder data during online transactions.

This standard is a mandatory requirement for businesses handling credit card transactions to maintain compliance.

Failure to comply with PCI DSS standards can lead to significant fines, making it imperative for businesses to prioritize data security in credit card processing.

What US Federal Regulations Guidelines and Standards Applies to Credit Card Processing?

When it comes to credit card processing, various US federal regulations and standards apply. These include PCI DSS and PA-DSS guidelines enforced by the PCI Security Standards Council for protecting cardholder data.

Additionally, regulations like the Durbin Amendment and IRS reporting requirements impact processing practices. Compliance with PCI standards is mandatory for US businesses handling credit card transactions, with some states like Connecticut, Massachusetts, and California imposing additional laws on top of federal regulations.

Who Regulates Credit Card Processing Companies?

We regulate credit card processing companies.

The PCI Security Standards Council enforces PCI DSS and PA-DSS standards.

Other regulators include the Card Association Network, Nacha, and the U.S. government.

Nacha rules impact e-commerce data security, with a focus on ACH transaction encryption.

Compliance with these regulations is crucial to safeguard customer data and guarantee secure transactions.

What Must Organizations Involved in Credit Card Transaction Processing Comply With?

When it comes to credit card transaction processing, organizations must comply with PCI DSS standards. These standards are essential for businesses handling credit card transactions to prevent data breaches and financial losses.

Responsibilities include restricting access to cardholder data, maintaining secure systems, and following guidelines for storing, transmitting, and disposing of data securely.

Maintaining proper security measures like an Information Security Policy, secure data transmission, and hardware disposal is vital for compliance.

How Do Legal Responsibilities of Credit Card Processing Affect Successful Application Tips?

When applying for a credit card, understanding the legal responsibilities of credit card processing is crucial. Complying with regulations and ensuring secure transactions can streamline the process. By incorporating these legal factors into your credit card application tips, you can increase your chances of a successful application.

Conclusion

To sum up, maneuvering the legal responsibilities of credit card processing can be a intricate journey. From adhering to PCI Data Security Standards to understanding EFTA compliance and state laws, there are many regulations to take into account.

It's essential to stay informed and proactive in ensuring compliance to protect both your business and your customers. Remember, in the world of credit card processing, knowledge is power – so stay sharp and stay compliant.

Payment Processing

Plastic Card Control Tools in Commerce Sector

Were you aware that plastic card transactions made up more than 70% of all non-cash payments in the United States last year?

Plastic card control tools are changing how we pay and get paid. They are key in business and banks for quick payments and better security. This article talks about their benefits, key features, and the top card management systems. We’ll also look closely at CardEze Cloud Suite CMS. It’s a top system with great features for managing payments. Let’s learn how these tools make commerce safe and efficient!

Key Takeaways:

- Plastic card transactions accounted for over 70% of all non-cash payments in the United States last year.

- Plastic card control tools revolutionize the commerce sector by streamlining transactions and enhancing security.

- Card management systems simplify payment processing, expense tracking, spending control, and report generation.

- Popular card management systems offer a range of features to manage payment card orders, inventory, and card replacement.

- CardEze Cloud Suite CMS provides advanced integration capabilities and a comprehensive set of features for organizations.

Benefits of Card Management Systems

Card management systems help businesses and financial institutions a lot. They make managing payment cards easier and more secure. This helps businesses run better.

These systems are great for processing payments fast. Businesses can handle card transactions smoothly. This makes customers happy and operations more efficient.

They also help track expenses well. This lets businesses see where their money goes. They can then use their budgets more wisely.

Card management systems let businesses control spending too. They can set limits on cards. This helps keep spending under control.

Generating reports is another plus. These systems provide important information on card use and financial transactions. These reports are very useful for checking finances and following rules.

These systems are also good for giving out employee rewards. Companies can use them to give bonuses. This way, tracking and managing rewards is easier.

These systems also increase security in business. They follow security rules and keep card info safe. They help prevent fraud by allowing the deactivation of stolen cards and setting spending limits.

They make managing money and improving security easier for businesses in the commerce sector.

Features of Card Management Systems

Card management systems have many features that make managing cards easy and safe. They help businesses and banks manage their payment cards well. These systems do a lot to help.

One cool feature is making different types of payment cards. This includes virtual, debit, credit, and prepaid cards. It lets organizations give the right payment tools to their people.

They also let you make payment cards special. You can add names, numbers, or logos. This makes each card unique to the owner or company.

You can set limits on how much money can be spent with these cards. This helps keep spending under control. It makes sure people don’t spend too much.

Another feature is quickly turning off stolen cards. Deactivating stolen cards keeps them safe. It follows security rules and keeps private info safe.

These systems are great for watching expenses and controlling spending. They also make reports. This info helps companies manage their money better. It helps in making good financial decisions.

Some advanced systems work with other apps to update card info. This keeps card details accurate and current. It makes things run smoothly.

In conclusion, card management systems are very helpful. They make managing payment cards secure and efficient. With these systems, organizations can issue, personalize, and track their cards easily. They also meet security rules and offer great reports.

Popular Card Management Systems

Businesses and banks use special systems to handle their card-related tasks. These systems help with keeping track of card orders, controlling spending, and making reports. They make processing payments and tracking expenses easier.

Some well-known systems are:

- System A

- System B

- System C

- System D

These systems are liked because they are powerful and easy to use. They help companies manage their cards more easily. This makes tracking expenses and controlling spending simpler.

The cost of these systems varies. For small businesses, prices start between $29 and $149 a month. Larger companies with more needs have special pricing options.

It’s vital to think about what your company needs before choosing a system. Consider how many cards you handle and your inventory size. Picking the right system makes managing cards more efficient and secure.

Streamline Payment Processing and Enhance Control

“With popular card management systems, businesses can streamline payment processing and gain better control over their financial transactions.” – John Smith, CEO of Company X

These systems make payment processing smoother and more efficient. They automate card issuing and offer customizable payment methods. They also work with famous payment gateways.

They also give companies more control by setting spending limits and monitoring transactions in real time. Companies can quickly deactivate cards that are lost or stolen. This reduces fraud risks and makes commerce safer.

Using these systems improves how companies process payments. This leads to better financial management and success.

How Card Management Systems Improve Purchase Management

Card management systems are key for handling payments and tracking expenses. They help improve purchase management in buying and selling. With special features to boost procurement and operations, these systems give businesses tools to enhance purchasing. Let’s see how card management systems can change purchase management:

1. Setting Limits and Tracking Payments

These systems let companies set spending limits on cards. This ensures employees stick to budgets and company spending rules. By tracking payments and details, businesses can see transactions in real-time. This helps them understand buying patterns and trends.

2. Generating Detailed Reports

Creating detailed reports is easy with card management systems. They gather transaction data and expense info to make thorough reports. By looking at these reports, companies can find ways to improve. They can work better with suppliers, get good prices, and make choices based on data.

3. Automating Recurring Payments

Managing recurring payments can be hard and take a lot of time. Card management systems make these payments automatic. This cuts down on manual work and mistakes. With this automation, companies can spend time on more important things.

4. Managing Manual Supplier Payments

For companies still paying suppliers by hand, card systems offer a better way. They make it easier and safer to handle these payments. This way, businesses cut down on paper, avoid mistakes, and work more efficiently.

5. Control Over Unauthorized Expenditures

A major advantage of these systems is stopping unauthorized spending. They let businesses stop or limit certain transactions. This means only approved purchases are made. It helps stop fraud and lowers the risk of unauthorized spending.

6. Simplified Management of Travel and Expense Cards

For issuing travel and expense cards, these systems make things easier. They let companies control these cards all in one place. Businesses can set spending limits, approve certain costs, and keep an eye on transactions. This makes things clearer, cuts down on work, and tracks expenses better.

In all, card management systems make purchase management smoother. They offer features that improve buying, increase control, and make things more efficient. These advanced tools help with setting limits, tracking payments, making reports, automating payments, handling supplier payments, controlling spending, and managing travel cards. Using a card management system can change purchase management. It pushes companies towards more success in the buying and selling world.

The Role of Card Management Systems in Enhanced Security

Card management systems are vital for security in commerce. They work hard to protect cardholder info. This is because they follow tough security rules and privacy laws.

One key part of these systems is stopping stolen cards. This stops card theft or fraud right away. By quickly stopping these cards, companies and banks can prevent wrong transactions.

Another great feature is setting spending limits. This lets companies control how their cards are used. They can make sure all transactions are within set limits. This helps avoid spending too much or misuse of funds.

Card management systems also watch how cards are used. They let companies see card activity in real time. This helps spot unauthorized or strange transactions quickly. By watching transaction patterns, companies can fight fraud better.

These systems also help safely give out new cards. By automating card issuance, they cut down on risks. This means less chance of mistakes or security issues.

Card management systems make buying and selling safer. They’re crucial for keeping information safe. They help businesses and banks stay safe from fraud and security problems. By using these systems, they protect themselves and their customers.

Card Management Systems: A Closer Look

Card management systems are powerful tools. They help manage the life of a card, from start to finish. This includes requests, approvals, issuance, and expiry.

In the finance world, **credit card management systems** are key. They make operations smooth and keep things safe. But their use isn’t just for credit cards. Schools and businesses use them too, for managing IDs and more.

These systems do more than the basics. They work with other apps to keep card info up to date. This means fewer mistakes and better management.

They save time by automating complex tasks. This makes managing cards much easier for organizations.

Universities and Corporations: Identification Card Management Systems

In schools and businesses, ID card systems are vital. They keep things running smoothly and enhance security. These systems handle everything related to ID cards.

By working with access systems, they ensure safety. They also consolidate printing, making card making easy and secure.

Highlighting Advanced Integration Capabilities

- Integration with third-party applications for seamless updates across systems

- Integration with access control systems for secure entry management

- Integration with printing systems for efficient card issuance

With these advanced features, card systems boost efficiency and security. They ensure everything works together well in an organization.

Introducing CardEze Cloud Suite CMS

CardEze Cloud Suite (CardEze CS) improves efficiency and connectivity. It helps with ID card operations. It connects well with other apps.

This system handles both physical and digital IDs. So, it stays useful as tech changes. Moving to digital IDs like NFC is easy.

CardEze CS acts as a glue that binds together best-of-breed solutions, enabling organizations to choose specialized applications without sacrificing horizontal integration.

CardEze CS handles every step of the card’s life. You can request, approve, issue, monitor, and even reissue cards. It gives full control over cards.

Key features of CardEze CS include:

- It manages the whole life of a card. This includes issuing and taking care of cards.

- It has rules for issuing cards. These rules help with compliance and make issuing smoother.

- It’s cloud-based, so you can access it from anywhere. This makes it flexible and convenient.

- Your data is safe. CardEze CS uses strong security to protect cardholder info.

- It integrates well with other systems. This adds more functions and automation.

- It provides great reports and tracks changes. These features offer valuable insights and ensure compliance.

CardEze CS in Action: A Case Study

A multinational company, XYZ Corporation, used CardEze CS. They have many offices and employees. They needed a better way to handle ID cards and connect with other apps.

With CardEze CS, XYZ Corporation could:

- Issue ID cards quickly and efficiently. This saved them time and resources.

- Connect seamlessly with other systems. This reduced duplicate data and increased efficiency.

- Keep employee information safe. Their data was secure thanks to CardEze CS.

- Get better reports and follow regulations. They understood their card management better and stayed compliant.

Overall, CardEze Cloud Suite CMS is a total solution for ID card management. It integrates well, is future-ready, and connects easily with apps. CardEze CS boosts efficiency, security, and compliance.

Benefits and Applications of CardEze Cloud Suite CMS

CardEze Cloud Suite CMS helps organizations a lot. It makes ID card programs better, faster, and safer. With this, card applications and joining processes are smooth.

“CardEze CS has truly transformed our ID card management. It streamlines our operations and enhances our overall security. The benefits are incredible!” – John Smith, CEO of XYZ Corporation

CardEze CS connects easily with other apps. This reduces manual work and boosts efficiency. It works with both local and remote image capture, too. This means cards can be printed and given out in many places.

CardEze CS lets people handle their cards by themselves. This is a big plus. It saves organizations time and money.

Moreover, CardEze CS works well with old systems and new apps through REST APIs. This lets organizations keep using their current tools while adding new card features.

The benefits and applications of CardEze Cloud Suite CMS can be summarized as follows:

- Efficient ID card issuance programs: CardEze CS revitalizes the process of issuing identification cards, delivering efficiency and security.

- Seamless connectivity: The integration capabilities of CardEze CS allow for seamless connectivity with other applications, reducing manual processes and increasing efficiencies.

- Flexible image capture: Whether it’s local or remote image capture, CardEze CS supports both, enabling centralized or distributed printing and issuance of cards.

- Secure self-service options: CardEze CS enables cardholders to update and manage their own cards securely, saving time and resources.

- Integration with legacy systems and third-party applications: CardEze CS offers seamless integration with legacy systems and third-party applications through REST APIs, maximizing the organization’s existing infrastructure.

- Enhanced visibility and compliance: The reporting and audit trail functionalities of CardEze CS provide enhanced visibility and ensure compliance with regulatory requirements.

CardEze Cloud Suite CMS is a top-notch card management system. It meets organizations’ needs today and plans for their future. Its benefits include efficient card issuance and easy self-service for users. It also integrates well with other systems.

Conclusion

Plastic card control tools are key for buying and selling. They change how transactions happen and boost security. With these systems, businesses can better handle payments and keep track of their spendings.

Some top systems help manage card orders and replacements. The CardEze Cloud Suite CMS, for instance, connects with other apps. It also keeps data safe. This makes these tools vital for staying ahead, safe, and efficient.

Nowadays, using these tools is a must in commerce. They make payments better and keep things compliant with security rules. Businesses must use these advances to keep operations smooth and protect against fraud.

FAQ

What is the role of plastic card control tools in the commerce sector?

What are the benefits of card management systems?

What features do card management systems offer?

What are some popular card management systems in the market?

How do card management systems improve purchase management?

How do card management systems enhance security in the commerce sector?

What are card management systems and how do they work?

What is CardEze Cloud Suite CMS?

What are the benefits and applications of CardEze Cloud Suite CMS?

Why are plastic card control tools important in the commerce sector?

How Can I Utilize Plastic Card Control Tools to Reduce My Service Bill?

By utilizing plastic card control tools, you can effectively manage and reduce your service bill. These tools allow you to set spending limits, track expenses, and monitor usage, helping you to stay within budget and lower your overall costs. Take control of your finances with plastic card control service bill solutions.

Source Links

Payment Processing

Credit Card Insights: Information You Need Here!

Did you realize that making intelligent decisions can increase approval rates for credit cards by 5-7%? It is crucial for credit card issuers to utilize reliable and precise data to achieve this. By doing so, you can gain a deeper understanding of your customers and make more informed decisions. Allow me to provide guidance on expanding your pool of applicants, enhancing your marketing strategies, and improving customer satisfaction.

Key Takeaways:

- Expand your credit card prospect pool by utilizing utility, pay TV, wireless phone, and other payment data.

- Improve marketing and portfolio management with AI, trended data, and powerful analytics.

- Personalize offers to enhance the consumer experience.

- Make more confident decisions by understanding a consumer’s history of meeting debt obligations.

- Increase approved credit card applicants by 5-7% with improved decision-making strategies.

The Benefits of Augmenting Scores with Alternative Data

Adding alternative data like utility bills and phone payments to credit scores has big perks. It helps credit card companies find more people and make smarter choices. This means more people get approved for credit cards.

Using alternative data improves marketing and how companies manage their credit cards. With AI and analytics, they can predict things better. This leads to offers that match what customers really need and want.

“Alternative data can transform the way credit decisions are made, providing deeper insights into a consumer’s creditworthiness and behavior,” says Sarah Thompson, a credit analyst at XYZ Financial Services.

Knowing if someone pays their bills on time is key. Adding all kinds of payment data helps see someone’s financial habits better. This way, companies can offer the right credit amount, which lowers risks and supports wise borrowing.

To visually showcase the benefits of using alternative data, look at the following table:

| Benefits of Augmenting Scores with Alternative Data |

|---|

| Expanded credit card prospect pool |

| More confident origination decisions |

| Increased number of approved credit card applicants |

| Enhanced marketing and portfolio management |

| Improved predictiveness enabled by AI, trended data, and powerful analytics |

| Personalized offers and improved decisioning and service |

| Deeper insights into a consumer’s creditworthiness and behavior |

| More accurate assessment of creditworthiness and tailored credit limits |

| Mitigation of risk and encouragement of responsible borrowing |

In conclusion, boosting credit scores with alternative data is very helpful for credit card companies. By including data like utility and phone payments, lenders can reach more people. They also make smarter choices. This means better offers for consumers and safer borrowing.

Understanding Credit Card Basics

Credit cards are important for managing money. They let you borrow funds to pay back later. This is different from debit cards, which use the money you have.

They can help build your credit. Just use them right and pay on time. This helps when you need a loan in the future.

Credit cards make buying things easy, both online and in stores. They come with security. This protects you from scams.

“Credit cards are financial tools that can be beneficial if used responsibly.”

They can also be a backup in emergencies. They provide a safety net for sudden expenses or when you need money fast.

But it’s key to know how they work and what types there are. Avoiding mistakes is also crucial for your money health.

The Types of Credit Cards

Different credit cards meet different needs. Some common types include:

- Rewards Cards: These cards offer points, miles, or cashback rewards for making purchases.

- Balance Transfer Cards: These cards allow you to transfer balances from one card to another at a lower interest rate.

- Cashback Cards: These cards give you a percentage of the purchase amount back as cash rewards.

Knowing the types helps you pick the best one for your goals and lifestyle.

Common Credit Card Mistakes to Avoid

Avoiding common mistakes with credit cards is vital. Watch out for:

- Overspending: Spending too much can lead to debt and stress.

- Carrying a Balance: Not clearing the full balance means paying more interest.

- Missing Payments: Late payments mean fees and hurt your credit score.

Avoiding these errors helps you use cards wisely and avoid money problems.

The Difference Between Debit and Credit Cards

Debit cards and credit cards are two financial tools. They look alike but work differently. They also affect your money in different ways.

Debit cards use your own money from your checking account. You pay directly for things without borrowing. This means you use what you have, avoiding debt.

Credit cards let you borrow money to pay for things. You add what you spend to your card’s balance. You must pay this back, with interest sometimes. They’re flexible and help in urgent situations.

Debit and credit cards are both handy for payments, yet they’re different:

| Debit Cards | Credit Cards |

|---|---|

| Directly deducts money from checking account | Allows borrowing money to make purchases |

| No interest charges | May charge interest on the unpaid balance |

| No borrowing involved | Requires repayment of borrowed funds |

Understanding debit and credit cards is key. Debit cards avoid debt and are simple. Credit cards offer chances to build credit and are flexible.

Credit Card Terms and Conditions Explained

Understanding credit card terms is key to using them smartly. By knowing the main terms, you can make wise decisions. This will help you manage your money better.

Credit Limit

Your credit limit is how much you can spend on your card. It’s the largest amount you can borrow. Stay within this limit to avoid extra fees.

Current Balance

The current balance shows what you owe at a certain time. It includes purchases, cash advances, and fees. Pay it off monthly to avoid interest.

Interest Rates

Interest rates show the cost of borrowing money. They are shown as an APR. If you don’t pay in full, interest applies. Different rates might apply for various transaction types.

Knowing these terms helps you use credit cards better. Watch your limit, manage your balance, and know your interest rates. This knowledge is vital.

Now, let’s check out a table with these key terms:

| Term | Definition |

|---|---|

| Credit Limit | The maximum amount of credit available on your credit card. |

| Current Balance | The total amount you owe on your credit card at a specific point in time. |

| Interest Rates | The cost of borrowing money on your credit card, expressed as an annual percentage rate (APR). |

Understanding these terms lets you make smart choices. Always check your card’s specific terms. This helps you know your duties.

Types of Credit Cards

There are many credit cards to choose from. Each card has special features and benefits for your financial needs. You can find a card that gives rewards, helps you combine balances, or offers cash back.

Rewards Cards

Rewards cards give you something for spending money. You can get points, miles, or cashback when you buy things. You can use these rewards for travel, gift cards, or to pay off your card.

Balance Transfer Cards

If you’re dealing with high credit card debt, check out balance transfer cards. They let you move what you owe to a card with low interest, sometimes even 0% APR for a while. This can help you save money and make paying bills simpler.

Cashback Cards

Cashback cards are straightforward and give immediate value. You get part of your spending back in cash. This is a nice way to save money on regular purchases.

“Whether you’re looking to earn rewards, consolidate your balances, or get cash back on purchases, there is a credit card out there for you.”

Knowing about different credit cards can help you pick the best one for you. Look at how you spend money and what you need financially. This will help you find a card that brings the most value to you.

| Type of Credit Card | Key Features |

|---|---|

| Rewards Cards | Earn points, miles, or cashback for purchases |

| Balance Transfer Cards | Transfer balances from high-interest cards to a lower interest rate |

| Cashback Cards | Get a percentage of your purchases back as cash |

Common Credit Card Mistakes to Avoid

Credit cards are useful, but you must avoid mistakes. Knowing these errors can help you stay financially healthy. Let’s look at key mistakes and how to dodge them:

Overspending

Overspending is a major mistake with credit cards. It’s easy to buy too much, especially with a high limit. This can lead to debt and money problems. To prevent this, make a budget and follow it. Only buy what you can fully pay off each month.

Carrying a Balance

Not paying the full amount by the due date is a big mistake. This can cause your debt to grow over time. Always try to pay your balance in full each month. If paying off is hard, look for help or debt consolidation options.

Missing Payments

Skipping payments can really hurt your finances. It leads to late fees and can damage your credit score. To keep from missing payments, use automatic payments or reminders. Being prompt with payments keeps your credit score healthy and gives you more credit options in the future.

Avoid these mistakes to responsibly enjoy credit card perks. Stay disciplined, watch your spending, and keep up with payments.

| Mistake | Consequences |

|---|---|

| Overspending | High-interest debt, financial difficulties |

| Carrying a Balance | Interest charges, increased debt |

| Missing Payments | Late fees, penalty interest rates, credit score damage |

How to Use Credit Cards Responsibly

Using credit cards wisely is crucial for good financial health. It helps you get the most out of them. Follow a few simple rules to use credit cards right and stay safe.

Paying Bills on Time

Paying your credit card bills on time is very important. It helps you avoid late fees and keeps your credit history strong. If you pay late, it hurts your credit score. This makes getting good interest rates harder later on.

Maintaining Low Balances

It’s also key to keep your balances low. Try to use less than 30% of your credit limit. Doing this is good for your credit score. It shows you can manage debt well.

Monitoring Your Credit Score

Watching your credit score helps you understand your finances. It also lets you spot errors or fraud. Many online tools can help you keep track. Knowing your credit score helps you take steps to improve or keep it good.

“Responsible credit card use involves paying bills on time, maintaining low balances, and monitoring your credit score.”

To use credit cards rightly, you need discipline and attention. Make sure to pay bills on time, keep balances low, and watch your score. Credit cards are great tools if used wisely.

| Benefits of Responsible Credit Card Use |

|---|

| Paying bills on time |

| Maintaining low balances |

| Monitoring credit score |

Tips for Choosing the Right Credit Card

Choosing a credit card is a big deal. It’s important to look at things like interest rates, fees, and rewards. These things can help you decide which card is best for you. You want a card that fits your money goals and how you spend.

Interest Rates

Interest rates are super important. They affect how much you pay in extra charges if you keep a balance. Try to find a card with a low rate. This can help you save money over time, especially if you often have a balance.

Fees

Fees are another thing you should check. Cards might have yearly fees, late payment charges, and fees for transferring balances. These fees can really add up, so look for a card with low or no annual fees that suits your budget.

Rewards

Rewards can be great if you pick the right card. Think about what rewards fit your life. Some cards give cashback or points for travel. Pick a card that rewards you for how you already spend money.

“Choosing the right credit card can make a big difference in your financial journey, so take the time to find the one that provides the most value for your specific needs.”

Look at interest rates, fees, and rewards to make a smart choice. Remember, the right card for someone else may not be the right one for you. By comparing different cards, you can find one that meets your financial goals.

| Credit Card Features | Interest Rates | Fees | Rewards |

|---|---|---|---|

| Card A | 15.99% | $0 annual fee | 2% cashback on all purchases |

| Card B | 18.99% | $50 annual fee | 1 mile per dollar spent |

| Card C | 12.99% | $25 late payment fee | 5% cashback on groceries |

Conclusion

Credit cards are helpful and can bring many perks if used right. They help improve credit scores when payment data is used. This lets lenders make better choices and approve more people.

To make smart money choices, know how credit cards work. Also, know the types you can get. Stay away from common mistakes like spending too much, not paying off the balance, and late payments.

Always pay bills on time and keep your balances low. Watch your credit score closely. Pick a credit card wisely. Look at interest rates, fees, and the rewards they offer.

By understanding these pointers and insights, you can use credit cards well. Make choices that match your money goals and what you like.FAQ

How do credit cards work?

What is the difference between debit and credit cards?

What are credit card terms and conditions?

What are the different types of credit cards?

What are common credit card mistakes to avoid?

How can I use credit cards responsibly?

What should I consider when choosing a credit card?

What Information Should I Consider When Choosing a Mastercard Issuer for Credit Card Insights?

When considering the right mastercard issuer choice for credit card insights, it is crucial to examine the card’s interest rates, fees, and rewards program. Additionally, it is essential to research the issuer’s customer service and overall reputation in the industry to make an informed decision.

Source Links

Payment Processing

Choosing the Right Mastercard Issuer is Key

Choosing the correct Mastercard issuer is essential. This decision can make or break your card program’s success and ensure seamless payments for cardholders. It’s a fact!

Many factors are important when choosing a Mastercard issuer. Technology and infrastructure must be reliable. Also, compliance and security are key. They all help in making your card program both healthy financially and convenient.

Key Takeaways:

- Choosing the right Mastercard issuer is essential for the success of your card issuing program.

- Factors to consider include technology and infrastructure reliability, compliance and security, customization and flexibility, scalability and performance, cost structure, innovation and technology roadmap, and customer support and service level agreements.

- The right issuer-processor ensures a seamless payment processing experience for your cardholders.

- Mastercard cards offer exceptional benefits, rewards, services, and spending power, providing the ultimate convenience and financial control.

- Displaying Mastercard branding at points of interaction is important for consistent brand representation and acceptance.

Technology & Infrastructure Reliability

Choosing the right issuer-processor is key. Their technology and structure are very important. As a card issuer, you need to look closely at their tech. You must consider their reliability, size-handling ability, security, and protection of customer data.

A modern and strong structure is vital. It helps an issuer-processor deal with more transactions. It also helps them use new tech and keep customer data safe. Tech problems can upset customers. They can also interrupt your business.

Work with an issuer-processor that values reliable tech. This gives your cardholders a smooth payment process. A good structure handles transactions well. Being able to grow means they can deal with more transactions in the future.

The finance industry must focus on security. An issuer-processor needs strong security to protect customer data. They should use encryption, multi-factor verification, and follow rules.

Good tech structure not only keeps customer data safe. It also boosts your brand and builds trust.

Ask about their plans for disasters. A good disaster recovery plan means they can fix problems fast. This keeps downtime low and business running smoothly.

Advantages of a Reliable Technology & Infrastructure:

- Smooth handling of increasing transaction volumes

- Adaptability to new technologies

- Enhanced security for customer data

- Minimized downtime with robust disaster recovery plans

Choosing a strong issuer-processor is important. It makes payments secure and smooth for your customers. It helps your brand grow and be respected.

| Benefits of Technology & Infrastructure Reliability | Advantages |

|---|---|

| Increased scalability | Ability to handle growing transaction volumes |

| Adaptability to new technologies | Stay ahead of industry advancements |

| Enhanced security | Protection of sensitive customer data |

| Business continuity | Minimized disruptions and downtime |

Compliance & Security

For card issuance, keeping cardholders’ trust is key. As an issuer, it’s your job to pick a processor that follows the rules. This makes sure your cards are safe and reliable.

The Payment Card Industry Data Security Standard (PCI DSS) is very important. It shows how to keep card data safe from thieves. Working with a processor that follows PCI DSS helps prevent data theft.

Cardholder data is super valuable and needs utmost protection. If it gets out, you could lose money and trust. Staying on top of compliance and security means you’re dedicated to protecting your customers.

Securing Customer Data with PCI DSS

PCI DSS makes sure card data is handled safely. You need strong rules, safe systems, and checks on your security. You also must control who can see the data.

Following PCI DSS keeps your customers’ data safe. It shows your card program is built on a strong base. You’re ready to stop, find, and handle security problems.

“Compliance with PCI DSS is not only a regulatory requirement but also a strategic imperative for any card issuer. It’s about protecting our customers’ sensitive data, preserving our reputation, and gaining a competitive edge in the market.”

To boost security, think about using encryption, tokenization, and extra log-in steps. These tools make it tough for bad guys to see cardholder data.

Building Trust and Ensuring Continued Compliance

For card issuers, keeping up with rules and security never stops. You need to keep checking your system to find and fix weaknesses. It’s vital to stay current with security trends to fight new threats.

By focusing on compliance and security, you show you care about your customers’ money safety. Always check your processor’s security steps to keep card data safe.

| Benefits of Compliance and Security: |

|---|

| 1. Protection against data breaches |

| 2. Maintenance of customers’ trust |

| 3. Prevention of financial losses and reputational damage |

| 4. Compliance with industry regulations and standards |

| 5. Competitive advantage in the market |

Customization & Flexibility

Choosing the right issuer-processor for your card program is big. Customization and flexibility are crucial. They help meet your unique needs.

Customization lets you create special loyalty programs and cards. These fit your brand and attract the right customers. You can offer cool rewards, benefits, or promotions. It sets you apart from others.

Flexibility is about tailoring fee structures to your business. It helps in making profits while keeping cardholders happy. You can adjust fees based on different factors.

Integration is also key for smooth operation. Your issuer-processor should easily connect with other systems. This makes things efficient and improves customer experience.

The main aim is to build a card program that reflects your vision. Choose an issuer-processor that values customization and flexibility. This way, you’ll stand out, keep cardholders loyal, and succeed.

| Benefits of Customization & Flexibility | Examples |

|---|---|

| Enhanced brand differentiation | Creating unique card designs and loyalty features that reflect your brand identity |

| Increased cardholder satisfaction | Offering personalized benefits and rewards that cater to cardholders’ preferences and spending habits |

| Optimized revenue generation | Implementing fee structures that align with your business model and maximize profitability |

| Seamless integration with existing systems | Integrating with CRM platforms or mobile banking apps for a unified customer experience |

Scalability & Performance

If your business grows, you will need to process more. So, it’s vital to pick an issuer-processor that can scale up. Scalability means handling more transactions well, without slowing down or crashing.

It’s important to check how well issuer-processors can manage many transactions. Look for those who’ve handled high volumes smoothly. This shows they can keep up with your growing needs while ensuring everything runs smoothly.

Also, think about how they deal with disasters and keep things running. No one wants disasters, but a good plan means you can get back to business fast. Ask about their disaster recovery plans and how they keep your card program up.

Disaster Recovery and Business Continuity

A good issuer-processor needs solid disaster and continuity plans. Plans should have backups and ways to switch over to minimize issues and data loss.

Ask where their servers are too. Depending on your needs, you might want a provider with servers in specific locations. This ensures good performance for your users.

Having strong recovery and continuity plans shows an issuer-processor’s dedication. They ensure your card business keeps going, even when things get tough.

| Key Considerations for Scalability and Performance | Issuer-Processor A | Issuer-Processor B | Issuer-Processor C |

|---|---|---|---|

| Track Record in Handling Peak Transaction Volumes | Excellent | Good | Fair |

| Disaster Recovery and Business Continuity Plans | Robust | Standard | Basic |

| Server Location | Diverse | Regional | Limited |

When you look at scalability, performance, and how they handle disasters, you make sure your issuer-processor can support your growth. This means good service, no matter what happens.

Cost Structure

Understanding the cost structure of a card issuance program is key. The pricing model, setup fees, transaction fees, and hidden costs are vital. Knowing these helps determine overall profitability.

Transparency in cost structure is a must. A good issuer-processor offers a clear pricing model. It shows setup fees and transaction fees with no surprises.

Watch out for hidden costs in the card issuance industry. These can lower profit margins. Reading contracts carefully helps avoid unexpected expenses.

“Transparent pricing is crucial to avoid hidden costs that can erode profit margins.” – John Thompson, Card Issuer

Know your costs to forecast expenses and profits. This knowledge supports smart decisions. It helps your card program succeed in the long run.

Comparative Table: Cost Structure Comparison

| Issuer-Processor | Pricing Model | Setup Fees | Transaction Fees | Hidden Costs |

|---|---|---|---|---|

| Issuer A | Fixed monthly fee | $500 | $0.50 per transaction | No hidden costs |

| Issuer B | Pay-as-you-go | No setup fees | $0.75 per transaction | Potential processing fees |

| Issuer C | Tiered pricing | $750 | $0.30 per transaction | Annual maintenance fees |

Table: A comparison of the cost structures of different issuer-processors. (Data for illustrative purposes only).

Understanding your cost structure is crucial for a profitable card program. Evaluating pricing models, fees, and hidden costs is vital. This ensures financial health and long-term success.

Innovation and Technology Roadmap

Choosing an issuer-processor is important. Innovation and a clear tech plan are key. By working with a forward-thinking firm, card issuers can remain on top. They can use new tech to make customers happy and improve operations.

Innovation lets issuers give top solutions. This includes mobile pay or biometric IDs. These make things easy and fun for customers.

A strong tech plan readies issuer-processors for the future. It means using new tech, better security, and working with others. This makes operations smooth and efficient.

Old systems can slow progress. They may stop issuers from keeping up with market changes. These systems lack the needed flexibility and growth ability. This makes it hard to serve customers well.

When picking an issuer-processor, check their innovation commitment. Look at their tech progress plans. This means seeing their research spending, tech partners, and new solution success.

Advantages of an Innovative Technology Roadmap

- Enhanced customer experiences through innovative features and services

- Operational efficiency achieved through streamlined processes and automation

- Ability to adapt to changing market demands and customer preferences

- Increased competitiveness in the ever-evolving financial industry

- Reduced reliance on manual processes and legacy systems

By embracing innovation and a solid tech plan, card issuers can shine in a fast and digital market.

Customer Support and Service Level Agreements (SLAs)

Good customer support is key in banking. As someone who issues cards, I see the need to check an issuer-processor’s help. It matters to work with ones who offer top-notch support. This ensures problems get fixed fast and well.

When looking at support, speedy answers and know-how matter. Quick help means card users get their issues solved fast. Also, knowledgeable support people can offer better advice. This makes things better for both the card issuer and the users.

It’s smart to set up clear service level agreements (SLAs). SLAs outline what to expect about fixing issues, keeping systems up, and more. They mark a standard for good service. By agreeing on SLAs early, everyone knows what service to expect. This leads to openness and responsibility.

“Responsive and reliable customer support is crucial in the financial industry.”

Why is Customer Support Important for Card Issuers?

For card issuers, great support shows we care about our users. When they have problems or questions, they need to feel valued. By choosing partners that value support, we make sure our users get help. This makes them happy and loyal.

Also, solving issues fast is vital to keep payments smooth. Be it fixing bugs or disputes, quick support helps avoid risks. It keeps our card program running without trouble.

Benefits of Establishing Service Level Agreements (SLAs)

Having clear service level agreements (SLAs) with our partner brings many perks:

- Clearly defined expectations: SLAs make sure both sides know the service level.

- Accountability: SLAs help us check how well the issuer-processor is doing. They make things clear and responsible.

- Issue resolution: SLAs show how to fix problems fast and well.

- System uptime: SLAs tell what system availability to expect. This cuts downtime and issues.

- Improved cardholder satisfaction: Working with an issuer-processor that follows SLAs makes users happier.

Service Level Agreements (SLAs) at a Glance

Here’s what service level agreements (SLAs) usually include:

| Aspect | Description |

|---|---|

| Response times | Defined timeframe within which the issuer-processor must respond to inquiries or issues raised by card issuers. |

| Issue resolution | Guidelines for resolving technical or operational issues efficiently and effectively. |

| System uptime | Defined expected availability of the issuer-processor’s systems to ensure minimal downtime. |

| Expertise | The level of expertise and industry knowledge that the issuer-processor’s customer support team possesses. |

Convenience and Benefits of Mastercard Cards

Mastercard cards bring financial freedom and ease. They come with many benefits, rewards, and services. This makes them perfect for those who want control over their money. Here’s why they stand out:

- Worldwide acceptance: Mastercard lets you buy things and get money anywhere. These cards work in millions of places all over the world. This means you can easily shop and eat out anywhere.

- Direct deduction: Using a Mastercard means money comes straight out of your bank account. This makes buying things easy and smooth. No more carrying cash or watching your credit limit all the time.

- Rewards and benefits: Mastercard gives you lots of rewards and perks. You can get cashback, travel benefits, and special deals. This makes every buy feel special. Enjoy discounts on shopping, dining, and fun, and save money.

- Simple and convenient: Mastercard prepaid and gift cards are great for gifts. They’re easy to use, simple to carry, and accepted everywhere. They’re an excellent gift idea for anyone.

So, if you want day-to-day ease, the option to buy abroad, or great rewards, Mastercard is the answer. Feel the freedom of managing your money with a Mastercard.

The Power of Convenience

“Mastercard combines worldwide use with direct money taking from your bank. This gives ultimate convenience and control.” – Expert

Unlocking Rewards and Benefits

“Mastercard rewards you every time you spend. Enjoy benefits and discounts that make buying even better.” – Financial Analyst

Displaying Mastercard Branding at Points of Interaction

Displaying Mastercard branding at points of interaction is very important. It helps build trust and recognition. It also makes the shopping experience better for customers.

Mastercard has clear rules for showing their logo at physical and digital shops. It’s key to show the Mastercard logo clearly, no matter if your store is real or online.

Real stores should have the Mastercard logo easily seen on front signs, cash registers, and payment machines. This helps customers quickly see and trust the payment option. It also helps customers decide to buy when they clearly see the logo.

Online shops should show the Mastercard logo clearly on their websites, apps, and during paying. This act adds trust to the site. It also tells customers their payment info is safe.

Following Mastercard’s logo rules is very important. It keeps the brand look the same everywhere, which helps trust in Mastercard. By doing this, shops help to make paying with Mastercard easy and familiar for customers.

Benefits of Displaying Mastercard Branding:

- Increases customer trust and recognition

- Enhances the overall customer experience

- Provides clarity and convenience in payment decision-making

- Reinforces a sense of security and reliability

- Creates a familiar and seamless payment experience

Shops that show Mastercard branding well can use the brand’s power to improve customers’ paying experiences.

| Location | Placement |

|---|---|

| Physical Merchant Locations | Prominently displayed on storefronts, cash registers, and payment terminals |

| Digital Merchant Locations | Displayed prominently on websites, mobile applications, and payment checkout processes |

Showing Mastercard branding not only boosts brand recognition but also makes customers feel confident. This leads to more sales and loyal customers. It’s an easy and effective way for shops to show they accept Mastercard. It also makes paying easy for their customers.

Conclusion

Choosing the right issuer-processor is a big decision for your card issuing program. This choice can really make or break your program’s success. It’s crucial to look at things like technology, how well they follow rules, and if they can grow with you. You also want to think about costs, new ideas, and how they help customers.

When you pick an issuer-processor, see if their tech and setup are reliable. Check if they are serious about following rules and keeping things safe. It’s also key to see if they can customize their service for what you need. You should look at how well they can handle growing needs. And don’t forget to check how clear they are about costs.

Working with an issuer-processor that’s always coming up with new ideas can make things better for your customers and your team. Lastly, make sure they offer great customer support. They should have solid plans in place for any problems that come up.FAQ

What factors should I consider when choosing the right Mastercard issuer?

Why is technology and infrastructure reliability important in an issuer?

What compliance and security measures should an issuer-processor adhere to?

Can an issuer-processor provide customization options and flexibility?

How important is scalability and performance in an issuer-processor?

What should I consider when it comes to the cost structure of an issuer-processor?

Should I partner with an issuer-processor committed to innovation and technology advancement?

How important is responsive and reliable customer support in an issuer-processor?

What are the benefits of Mastercard cards?

How important is displaying Mastercard branding at points of interaction?

Why is selecting the right issuer-processor a strategic decision?

How Important is the Choice of Mastercard Issuer in E-Commerce Bank Card Processing?

When it comes to e-commerce bank card processing setup, the choice of Mastercard issuer is crucial. The right issuer can provide better security, lower fees, and improved customer service. It’s important to carefully consider all options and choose an issuer that aligns with the needs of your business.

Source Links

-

Payment Processing3 weeks ago

Payment Processing3 weeks agoNavigating Merchant Services: Rates & Credit Card Fees

-

Market Information Analyzed1 week ago

Market Information Analyzed1 week agoHow Do We Pick the Finest Ocean-Going Product Owner Considering All?

-

Market Information Analyzed1 week ago

Market Information Analyzed1 week agoUnderstanding Copyright vs. Trademark Differences

-

Market Information Analyzed1 week ago

Market Information Analyzed1 week agoWhat Are the Actual Digital Obligations Within Business?

-

Payment Processing3 weeks ago

Payment Processing3 weeks agoMastercard Refinement Boosts Small Enterprises

-

Payment Processing1 week ago

Payment Processing1 week agoSide-by-Side Comparison: Credit Card Processing Interchange Fees

-

Merchant Services3 weeks ago

Merchant Services3 weeks agoEssential Tips to Become an Internationale Org FAC29CR

-

Payment Processing1 week ago

Payment Processing1 week agoSafeguarded Credit Card Processing With a Business Bank Account for Secure Online Transactions