Were you aware that payment reconciliation is an essential responsibility for finance professionals? This procedure confirms the correctness and thoroughness of financial transactions, aiding in the prevention of fraud and identification of cash flow issues. Precise payment documentation is crucial for maintaining healthy finances and guaranteeing the seamless operation of your business.

Key Takeaways:

- Payment reconciliation is crucial for accurate financial records and fraud prevention.

- Establish a reconciliation schedule to ensure timely and accurate recording of transactions.

- Keep detailed records of invoices, receipts, and bank statements for easy reference.

- Regularly reconcile bank accounts to identify errors and discrepancies.

- Use automation tools to streamline the payment reconciliation process and reduce errors.

Set Up a Reconciliation Schedule

As a finance professional, I understand the importance of timely and accurate payment reconciliation. To ensure the smooth operation of your financial processes, it’s crucial to establish a reconciliation schedule and adhere to it diligently. By setting up a routine, you can streamline your reconciliation efforts and maintain the accuracy of your financial records.

Depending on the volume of transactions your business handles, you may need to reconcile on a daily, weekly, or monthly basis. This regular cadence allows you to stay on top of your financial obligations and identify any discrepancies promptly.

“Setting up a reconciliation schedule helps businesses stay organized and maintain financial accuracy. It provides a structured framework for reviewing and verifying transactions, ensuring their completeness and accuracy.”

By committing to a reconciliation schedule, you can prevent errors from accumulating and reduce the risk of financial mismanagement. It also helps you stay compliant with regulatory requirements and provides a solid foundation for decision-making based on reliable financial data.

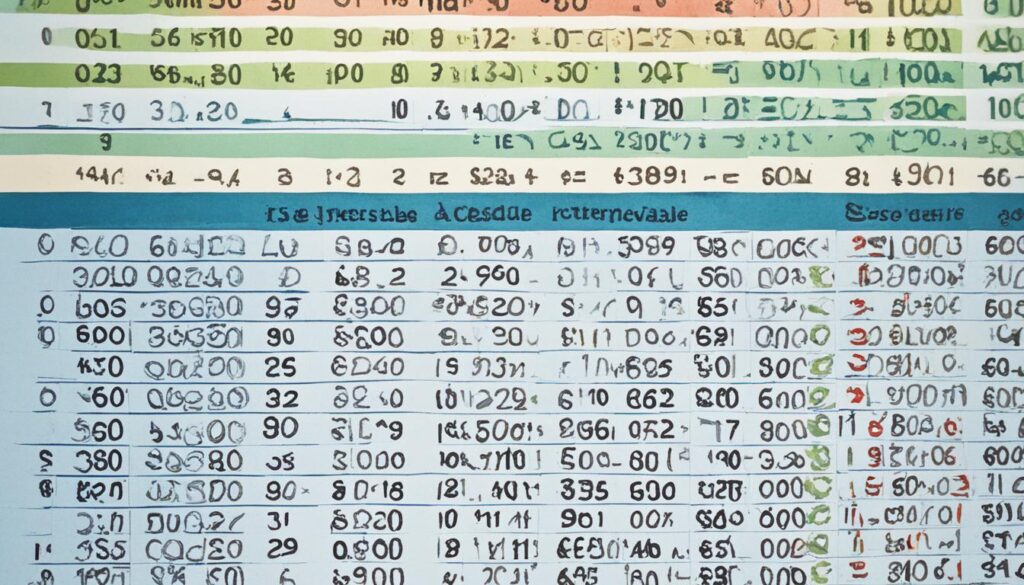

To illustrate the benefits of a reconciliation schedule, let’s take a look at an example:

| Date | Reconciliation | Notes |

|---|---|---|

| Monday | Bank Reconciliation | Reconciled bank statements with accounting software |

| Wednesday | Accounts Receivable Reconciliation | Matched invoices and receipts with customer payments |

| Friday | Accounts Payable Reconciliation | Verified vendor invoices and matched them with payments |

By aligning your reconciliation tasks with a predefined schedule, you can ensure that each aspect of your financial transactions receives the attention it deserves. This approach promotes consistency, minimizes errors, and enhances your overall financial management practices.

Remember, timely payment reconciliation is the backbone of financial accuracy and enables you to make informed business decisions. Develop a reconciliation schedule that suits your business’s needs and stick to it. The commitment to your schedule will pay off in the form of streamlined financial processes and enhanced operational efficiency.

Keep Detailed Records

Accurate payment reconciliation relies on maintaining detailed records of all financial transactions. By keeping comprehensive records, including invoices, receipts, and bank statements, you can ensure that your payment reconciliation process is precise and efficient. Detailed records provide the necessary documentation to match transactions in your bank statement with those in your accounting software, minimizing errors and discrepancies. Furthermore, organized and easily accessible records facilitate the identification of any potential issues, allowing for timely resolution.

When it comes to invoicing, it is essential to generate and retain detailed invoices that contain all relevant information, such as the customer’s name, date of purchase, itemized breakdown of the products or services provided, and payment terms. Clear and accurate invoices not only help in recording transactions but also serve as a communication tool between you and your customers.

“Detailed records provide the necessary documentation to match transactions in your bank statement with those in your accounting software, minimizing errors and discrepancies.”

Receipts are another crucial piece of documentation that should be kept on record. When you receive payments or make purchases, ensure that you obtain detailed receipts. These receipts help validate and support the transactions recorded in your financial records, enabling a more accurate representation of your company’s financial position.

Bank statements are a vital source of information for payment reconciliation. It is essential to regularly review and retain bank statements, as they serve as a verification tool for the accuracy of transactions. By comparing your bank statements with your accounting software, you can identify any discrepancies and take the necessary steps to rectify them.

Remember, maintaining detailed records is not only essential for payment reconciliation but also beneficial for overall financial management. Accurate and well-organized records facilitate auditing processes and provide valuable insights into your company’s financial performance and stability. Additionally, they help establish transparency and trust with stakeholders, such as investors, lenders, and regulatory bodies.

Key Points to Remember:

- Keep detailed records of all financial transactions, including invoices, receipts, and bank statements.

- Generate and retain clear and accurate invoices with essential details such as customer information, purchase date, itemized breakdown, and payment terms.

- Obtain and store detailed receipts to support transactions and validate financial records.

- Regularly review and retain bank statements to verify the accuracy of recorded transactions.

- Accurate and well-organized records facilitate auditing, provide insights into financial performance, and establish transparency with stakeholders.

Regularly Reconcile Bank Accounts

Regular bank reconciliation is a crucial practice to ensure the accuracy and integrity of your financial records. By reconciling your bank accounts on a regular basis, you can identify errors and discrepancies, ensuring that all transactions are accurately recorded in your accounting system.

Bank errors or unnoticed transactions can affect your financial reports and lead to inaccurate financial insights. To avoid these pitfalls, I recommend reconciling your bank accounts at least once a month, or more frequently if your business has a high volume of transactions.

During the bank reconciliation process, compare the transactions listed in your bank statement with those recorded in your accounting software. Look for any discrepancies, such as missing transactions, incorrect amounts, or unauthorized charges. By identifying and resolving these errors promptly, you can maintain accurate and reliable financial records.

Here is an overview of the steps involved in regularly reconciling your bank accounts:

- Collect your bank statement and any supporting documents, such as check stubs, deposit slips, and receipts.

- Compare the transactions listed in your bank statement with those recorded in your accounting software.

- Verify that the beginning and ending balances match between your bank statement and accounting records.

- Identify any discrepancies or errors, such as missing transactions, duplicate entries, or incorrect amounts.

- Investigate and resolve the discrepancies by contacting your bank or updating your accounting records as needed.

Regular bank reconciliation not only helps you identify errors but also ensures that your financial records are accurate and reliable. With accurate recording and reconciling of your bank accounts, you can make informed financial decisions and maintain the stability of your business.

By regularly reconciling your bank accounts, you can have peace of mind knowing that your financial records are accurate, allowing you to make informed business decisions. Stay on top of your finances and prioritize accurate recording to foster a strong financial foundation for your business.

Use Automation Tools

Automation tools are a game-changer when it comes to streamlining the payment reconciliation process and saving time. With the help of accounting software like QuickBooks, Xero, or Wave, you can automate the matching of transactions in your bank statement with those in your accounting system, significantly reducing the risk of errors.

By leveraging automation tools, you can eliminate the manual effort of manually comparing and matching transactions, allowing you to focus on more strategic financial tasks. These tools use algorithms and advanced technology to accurately and efficiently reconcile payments, ensuring your records are always up to date and error-free.

QuickBooks, Xero, and Wave are among the leading accounting software options available in the market. Let’s take a closer look at each:

| Automation Tool | Description |

|---|---|

| QuickBooks | QuickBooks is a popular accounting software that offers comprehensive features for small businesses. It allows you to automate payment matching, track expenses, manage invoices, and generate financial reports. With its user-friendly interface and robust functionality, QuickBooks simplifies the payment reconciliation process. |

| Xero | Xero is another top-notch accounting software that provides automation capabilities for payment reconciliation. It enables you to integrate your bank accounts and credit cards, automatically matching transactions with your accounting records. Xero offers real-time visibility into your financials, helping you stay on top of your cash flow. |

| Wave | Wave is a free accounting software designed for small businesses and freelancers. It offers automation features that allow you to effortlessly reconcile payments and track expenses. Wave also provides access to other useful tools like invoicing, receipt scanning, and financial reporting. |

With these automation tools, you can enhance accuracy, efficiency, and productivity in your payment reconciliation process. By reducing errors and eliminating manual tasks, you can have peace of mind knowing that your financial records are robust and reliable.

Automation tools like QuickBooks, Xero, and Wave empower you to manage payment reconciliation effectively, saving you time and effort while ensuring financial accuracy. Embrace the power of automation, and witness the transformation it brings to your financial operations.

Check for Fraudulent Transactions

When it comes to payment reconciliation, one of the greatest challenges businesses face is identifying fraudulent transactions. These transactions can easily slip through the cracks if payment reconciliation is not done accurately and in a timely manner. To protect your finances and maintain the integrity of your records, it is crucial to be vigilant and proactive in detecting and investigating any unusual transactions.

One way to safeguard against fraudulent transactions is by using fraud detection tools. These tools are designed to monitor your transactions regularly and identify any suspicious or fraudulent activity. By leveraging the power of technology, you can significantly reduce the risk of falling victim to fraudulent transactions and protect your business’s financial well-being.

“Fraud detection tools are invaluable in preventing financial losses and maintaining the trust of your customers. Implementing these tools as part of your payment reconciliation process is a proactive approach to safeguarding your business.”

How to Spot Fraudulent Transactions

The key to detecting fraudulent transactions lies in careful observation and analysis of your financial data. Keep an eye out for the following warning signs:

- Unusual payment amounts or patterns

- Transactions from unfamiliar or suspicious sources

- Duplicate payments or payments with incorrect details

- Abnormally high volume of transactions within a short period

- Transactions falling outside normal business hours or locations

If you notice any of these red flags, it is essential to take immediate action. Investigate the transactions further, consult with your finance team or professionals, and engage with the appropriate authorities if necessary.

Using Fraud Detection Tools

Fraud detection tools are designed to automate the process of identifying and flagging suspicious transactions. These tools employ advanced algorithms and machine learning techniques to analyze transaction data and identify patterns that indicate potential fraudulent activity.

Some popular fraud detection tools include:

- XYZ FraudGuard: XYZ FraudGuard is a comprehensive fraud detection solution that uses real-time data analysis to detect and prevent fraudulent transactions.

- ABC FraudBuster: ABC FraudBuster offers robust fraud detection capabilities, including anomaly detection, rule-based fraud prevention, and transaction monitoring.

- DEF SecureDetect: DEF SecureDetect leverages artificial intelligence and behavioral analytics to identify and mitigate risks associated with fraudulent transactions.

By incorporating these or similar fraud detection tools into your payment reconciliation process, you can significantly enhance your ability to identify and prevent fraudulent transactions. Remember, prevention is always better than cure when it comes to fraud.

Now that we’ve covered the importance of checking for fraudulent transactions and the role of fraud detection tools, let’s move on to the next section, where we will explore the benefits of reconciling your payments in real-time.

Reconcile in Real-Time

When it comes to payment reconciliation, staying on top of your financial records is crucial. Real-time payment reconciliation ensures that your records are always up-to-date, giving you a clear and accurate picture of your financial status.

By reconciling in real-time, you can identify any discrepancies or errors as soon as they occur. This allows you to take immediate action and resolve issues before they become larger problems.

To make real-time payment reconciliation more effective, it’s important to set up alerts and notifications. These alerts will notify you whenever there are inconsistencies in your financial transactions, ensuring that you stay informed and can address any issues promptly.

With up-to-date financial records and timely alerts, you can maintain the integrity of your financial data and make informed decisions for your business.

Reconciling in real-time not only provides peace of mind but also allows you to proactively manage your finances. By promptly addressing discrepancies, you can prevent potential financial risks and ensure the accuracy of your records.

Keep an Eye on Cash Flow

Effective payment reconciliation requires monitoring cash flow regularly. By keeping a close eye on your cash flow statements, you can identify any potential cash flow issues and take timely action to address them.

Cash flow monitoring involves tracking the movement of money in and out of your business. It helps you understand the timing and amount of cash coming in from sales, as well as the cash going out for expenses and payments. By regularly reviewing your cash flow statements, you gain valuable insights into your business’s financial health and stability.

Identifying cash flow issues early on allows you to proactively manage your finances and make informed decisions to ensure the smooth operation of your business. Here are some key benefits of monitoring cash flow:

“Cash flow monitoring is like having a financial pulse on your business. It helps you stay on top of your financial obligations, maintain a healthy cash position, and make strategic decisions with confidence.”

Why is Cash Flow Monitoring Important?

Cash flow monitoring is essential for several reasons:

- Identify Cash Flow Issues: Regularly reviewing your cash flow statements allows you to spot any potential issues, such as late customer payments, excessive expenses, or seasonality-related cash flow fluctuations. By identifying these issues early, you can take proactive measures to address them and minimize their impact.

- Ensure Financial Stability: By monitoring your cash flow, you can ensure that your business has enough liquidity to cover its short-term obligations and remain financially stable. This helps you avoid cash shortages, missed payments, and disruptions to your operations.

- Make Informed Decisions: Cash flow insights provide valuable information for making informed business decisions. For example, if you anticipate a cash flow surplus, you may choose to invest it in growth opportunities or pay off debts ahead of schedule. On the other hand, if you anticipate a cash flow shortfall, you can proactively cut expenses or seek additional financing options.

Tracking Cash Flow with Cash Flow Statements

Cash flow statements are financial reports that track the inflows and outflows of cash in your business over a specific period. They provide a detailed breakdown of your cash flow sources (operating activities, investing activities, and financing activities) and help you analyze and interpret your cash flow performance.

| Cash Flow Category | Amount (USD) |

|---|---|

| Operating Activities | +10,000 |

| Investing Activities | -5,000 |

| Financing Activities | -2,000 |

| Net Cash Flow | +3,000 |

By analyzing your cash flow statements, you can gain insights into your cash flow patterns and trends. This allows you to make informed decisions, such as optimizing your sales and collections process, negotiating better payment terms with suppliers, or adjusting your expenses to align with your cash flow.

Remember, cash flow monitoring is an ongoing process. Regularly reviewing and analyzing your cash flow statements will provide you with the information you need to ensure the financial health and stability of your business.

Introduction to Accounts Receivable

In the world of finance, accounts receivable plays a vital role in the success of a business. Understanding the basics of accounts receivable is crucial for financial stability and effective cash flow management.

Accounts receivable refers to the outstanding money that a business is owed for the goods or services it has provided to its customers on credit. It represents a company’s receivables or assets, which can be converted into cash. Managing accounts receivable efficiently is vital for maintaining a steady cash flow and ensuring the financial stability of a business.

Having a deep understanding of accounts receivable and implementing proper management strategies allows companies to optimize their cash flow and financial health. In the following sections, I will delve further into the importance of accounts receivable, its role in business, key terms associated with it, and best practices for effective management.

Importance of Accounts Receivable

Accounts receivable plays a crucial role in the financial health of a business. It serves as a key component of working capital, directly impacting cash flow and the overall financial stability of the company. Understanding the importance of accounts receivable is essential for managing and maintaining a healthy financial position.

Accounts receivable represents the funds that a business is owed by its customers for goods or services provided on credit. These outstanding receivables can be converted into cash, providing the company with the necessary funds to cover operational expenses, invest in growth opportunities, or repay debts.

Having a solid understanding of accounts receivable is vital for effective cash flow management. By closely monitoring and managing outstanding receivables, businesses can ensure a steady inflow of cash, allowing them to meet their financial obligations, seize growth opportunities, and maintain financial stability.

Accounts receivable also reflects the financial health of a company and its ability to manage customer relationships. Timely collection of outstanding payments demonstrates the company’s effectiveness in credit management and its commitment to honoring customer agreements. Strong accounts receivable management not only improves financial performance but also fosters positive customer relationships and builds trust.

Role of Accounts Receivable in Business

Accounts receivable plays a pivotal role in the financial health and success of a company. It serves as a significant source of liquidity, providing businesses with the working capital necessary to cover operational expenses and invest in growth opportunities. Efficient management of accounts receivable allows companies to allocate resources effectively and optimize their overall financial performance.

Financial Health: Accounts receivable is a key factor in assessing the financial health of a business. It represents the outstanding money owed by customers for the goods or services provided on credit. A healthy accounts receivable balance indicates that a business has successfully managed its credit and collection processes, leading to consistent cash inflows and a strong financial position.

Liquidity: Accounts receivable provides businesses with the necessary liquidity to meet their day-to-day operational requirements. The timely collection of receivables ensures a steady cash flow, which can be used to cover various expenses, such as payroll, inventory replenishment, and equipment maintenance.

Customer Relationships: Effective management of accounts receivable is vital for building and maintaining strong customer relationships. By offering convenient payment terms, businesses can attract loyal customers and foster long-term partnerships. Promptly addressing any payment issues or concerns can also enhance customer satisfaction, trust, and loyalty.

Accounts receivable serves as a crucial indicator of a business’s creditworthiness and its ability to manage customer relationships effectively. A well-maintained accounts receivable system reflects the efficiency and professionalism of the organization, instilling confidence in its customers and stakeholders.

“Efficient management of accounts receivable allows businesses to maintain a healthy and sustainable cash flow, which is the lifeblood of any organization.”

The Accounts Receivable Process

The accounts receivable process involves several steps to ensure timely payment from customers and maintain accurate records of transactions. These steps include:

- Invoice generation and dispatch: Create invoices detailing the goods or services provided to customers on credit.

- Payment tracking and recording: Monitor and record customer payments to keep track of outstanding balances.

- Regular reconciliation of accounts receivable data: Compare the recorded payments with the outstanding invoices to ensure accuracy and identify any discrepancies.

With proper execution of the accounts receivable process, businesses can effectively manage their cash flow, improve financial stability, and maintain positive customer relationships.

To illustrate the accounts receivable process:

| Date | Invoice Number | Customer | Amount | Status |

|---|---|---|---|---|

| Jan 1, 2022 | INV-001 | ABC Company | $1,000 | Paid |

| Jan 5, 2022 | INV-002 | XYZ Corporation | $2,500 | Outstanding |

| Jan 10, 2022 | INV-003 | 123 Enterprises | $1,200 | Paid |

By following these steps and maintaining accurate records, businesses can effectively manage their accounts receivable and ensure consistent cash flow.

Key Terms in Accounts Receivable

Accounts receivable is a fundamental aspect of managing a company’s finances. To gain a better understanding of this process, it’s important to familiarize yourself with key terms related to accounts receivable. Two crucial concepts in this area are the aging of accounts receivable and bad debt with allowance methods.

Aging of Accounts Receivable

The aging of accounts receivable refers to the classification of outstanding customer invoices based on their due dates. By categorizing invoices into different aging buckets, businesses can assess the level of delinquency and prioritize their collection efforts accordingly.

Below is an example of the aging of accounts receivable:

| Age of Invoice | Total Outstanding Balance |

|---|---|

| Current (0-30 days) | $10,000 |

| 31-60 days | $5,000 |

| 61-90 days | $3,000 |

| Over 90 days | $2,000 |

By analyzing the aging of accounts receivable, businesses can have a clear understanding of their outstanding balances, prioritize collection efforts, and proactively follow up with customers to ensure timely payments.

Bad Debt and Allowance Methods

Bad debts are debts that are deemed unlikely to be collected from customers. Every business faces the risk of bad debts, which can arise due to customer bankruptcies, financial difficulties, or other reasons. To account for potential losses from these bad debts, businesses establish an allowance for bad debts.

The allowance for bad debts is a contra-asset account that reduces the total accounts receivable value on the balance sheet to reflect the estimated amount that the company is unlikely to collect. By having an allowance for bad debts, businesses take into account the potential write-offs and accurately represent the true value of their accounts receivable.

It’s important to note that the estimation of bad debts and the establishment of the allowance is based on the historical data and industry norms. The allowance is maintained to protect the company’s financial statements from potential losses due to uncollectible debts.

Maintaining a clear understanding of the aging of accounts receivable and implementing appropriate allowance methods for bad debts is crucial for businesses to manage their cash flow effectively and maintain a healthy financial position.

Use Electronic Billing & Online Payments

Switching to electronic invoicing and online payment systems can streamline the payment collection process and reduce errors. Electronic billing allows clients to make payments easily online, and integrated payment processing automates record-keeping and reduces human error.

By adopting electronic billing, businesses can enjoy faster and more convenient payment processing. Clients no longer need to rely on traditional methods such as mailing checks or making in-person payments. Instead, they can conveniently pay invoices online with just a few clicks. This not only improves customer satisfaction but also accelerates cash flow.

Furthermore, online payments provide a higher level of accuracy compared to manual processes. Integrated payment processing ensures that all transactions are automatically recorded in your system, eliminating the need for manual data entry. This reduces the risk of errors and ensures that your records are up-to-date and accurate.

Automating record-keeping through electronic billing and online payments also simplifies the payment reconciliation process. With all payment data automatically recorded in your accounting system, you can easily match transactions with corresponding invoices and track outstanding payments. This makes the payment reconciliation process more efficient and less time-consuming.

Additionally, electronic billing and online payments offer improved security. With secure payment gateways and encryption protocols, the risk of fraudulent activities is significantly reduced. Clients can have peace of mind knowing that their sensitive payment information is protected.

In conclusion, embracing electronic billing and online payments not only streamlines the payment collection process but also automates record-keeping, reduces errors, and improves security. It’s a win-win for businesses and their clients, providing convenience, accuracy, and peace of mind.

Use the Right KPIs

Tracking key performance indicators (KPIs) related to accounts receivable is crucial for assessing the effectiveness of your payment collection process and improving financial management. By analyzing metrics such as Days Sales Outstanding (DSO), Average Days Delinquent (ADD), turnover ratio, Collection Effectiveness Index (CEI), and revised invoices, you can gain valuable insights into your cash flow, customer payment behavior, and areas for enhancement.

Key Accounts Receivable Performance Metrics

Let’s take a closer look at these essential performance metrics:

| Metric | Description |

|---|---|

| Days Sales Outstanding (DSO) | Measures the average number of days it takes to collect payments after a sale. It indicates the effectiveness of your receivables management and the speed of cash conversion. |

| Average Days Delinquent (ADD) | Calculates the average number of days that payments are overdue. ADD helps identify trends in late payments and potential cash flow concerns. |

| Turnover Ratio | Determines how quickly your accounts receivables are being paid off within a specific period. It reflects the efficiency of your collection efforts and the frequency of customer payments. |

| Collection Effectiveness Index (CEI) | Measures your ability to collect outstanding payments by comparing the actual collections against the total collectible amount. CEI gauges the efficiency of your credit and collection processes. |

| Revised Invoices | Represents the number of invoices that had to be adjusted or amended due to errors or disputes. Monitoring the frequency of revised invoices helps identify process gaps and improves invoice accuracy. |

By staying on top of these accounts receivable performance metrics, you can identify areas of improvement, streamline your collections process, and maintain a healthy financial position.

Next, we’ll explore the importance of accurate payment reconciliation and maintaining financial accuracy in the conclusion of this article.

Conclusion

Mastering payment reconciliation requires discipline, attention to detail, and a commitment to accuracy and timeliness. By following best practices such as setting up a reconciliation schedule, keeping detailed records, using automation tools, and monitoring cash flow, businesses can ensure efficient and effective payment reconciliation, leading to accurate and up-to-date financial records.

Establishing a reconciliation schedule helps you stay on top of your payment reconciliation process, ensuring timely and accurate processing. Keeping detailed records, including invoices, receipts, and bank statements, provides the necessary documentation to reconcile transactions accurately. Using automation tools such as QuickBooks, Xero, or Wave reduces the risk of human error and streamlines the reconciliation process.

Monitoring cash flow and regularly reconciling bank accounts allows you to identify errors, discrepancies, and potential fraud promptly. Real-time payment reconciliation, coupled with fraud detection tools, further enhances financial accuracy and security. By implementing these best practices, businesses can maintain financial stability, make informed decisions, and foster trust with their stakeholders.

FAQ

How do I set up a reconciliation schedule?

Why is it important to keep detailed records?

How often should I reconcile my bank accounts?

How can automation tools help with payment reconciliation?

How can I detect fraudulent transactions?

What are the benefits of real-time payment reconciliation?

Why is it important to monitor cash flow regularly?

What is accounts receivable?

Why is accounts receivable important for a business?

What is the role of accounts receivable in a business?

What are the steps involved in the accounts receivable process?

What is the aging of accounts receivable?

How can electronic billing and online payments help with accounts receivable?

What are the key performance indicators (KPIs) related to accounts receivable?

What are the best practices for payment reconciliation?

What are the best practices for managing and recording payments to avoid duplication?

When managing and recording payments, it is crucial to implement duplicating payments safely techniques to prevent errors. Utilize a centralized system for recording payments, establish clear processes for reconciliation, and regularly conduct audits to identify and rectify any duplicate payments. These best practices will ensure accuracy and efficiency in payment management.