Mastering Automated Onboarding for Payment Processing offers a strategic approach to boost efficiency, cut costs, and enhance customer satisfaction. By streamlining the merchant account setup process, speeding up approvals, and broadening payment options, this method ensures exceptional operational performance. Understanding concepts like MTOT Disc and MCC Codes also contributes to improved efficiency and risk control. This focused strategy not only addresses evolving customer needs but also strengthens operational supervision. Adopting automated onboarding can lead to significant benefits in the payment processing arena.

Key Takeaways

- Utilize MTOT Disc for secure tokenization and efficient data verification.

- Implement MCC codes to categorize businesses and set appropriate processing fees.

- Streamline application processes with essential information and clear instructions.

- Enhance payment processing efficiency with quicker approvals and diverse options.

- Ensure compliance for high-risk merchants with robust KYC procedures and ongoing monitoring.

Benefits of Automated Onboarding

Automated onboarding greatly enhances efficiency and reduces costs in setting up merchant accounts. By utilizing an automated onboarding process, businesses can streamline the setup of merchant accounts, leading to quicker approvals and broader payment options for eCommerce sub-merchants. This efficiency not only benefits the company by saving time and resources but also enhances customer satisfaction and relationships by providing a seamless onboarding experience.

The automated onboarding process minimizes delays in processing merchant applications, resulting in faster transactions and improved operational effectiveness. For ISVs and SaaS companies, efficient onboarding builds strong customer relationships, fostering trust and loyalty. Through the automation of various tasks involved in merchant onboarding, businesses can achieve significant cost reductions and operational efficiencies, ultimately leading to a more competitive edge in the market.

Merchant Onboarding Process Overview

To understand the intricacies of the merchant onboarding process, it's crucial to grasp the various stages involved in evaluating financial risk and analyzing financial and legal data. Automated merchant onboarding streamlines the credit card processing journey, leading to efficiency, cost reduction, and enhanced customer satisfaction. By automating this process, businesses can offer a broader range of payment options for eCommerce sub-merchants while minimizing delays in application processing.

Implementing an automated onboarding system presents challenges, such as selecting the appropriate payment partner and technology to support the process effectively. The onboarding process typically includes pre-screening, identity verification, a review of the merchant's history, and additional checks for high-risk merchants. These steps are vital in ensuring the security and reliability of the credit card processing system. By understanding the automated merchant onboarding process overview, businesses can navigate the complexities of credit card processing with more control and efficiency.

Understanding MTOT Disc

MTOT Disc, or Merchant Tokenization Onboarding Token Discovery, is a crucial process in the realm of payment processing. This method aids in securely tokenizing merchant information, ensuring secure and efficient transactions.

MTOT Disc Definition

Streamlining the merchant onboarding process, the MTOT Disc tool efficiently collects and verifies merchant data for quick approval. This automated onboarding tool plays a vital role in enhancing the customer experience by minimizing delays in processing merchant applications.

By swiftly gathering and validating essential merchant data, MTOT Disc ensures a seamless and expedited approval process. Businesses seeking to broaden their payment options and streamline onboarding procedures rely on MTOT Disc for its effectiveness in expediting the onboarding process.

With its ability to facilitate the verification of merchant information promptly, this tool is an indispensable asset for organizations aiming to improve operational efficiency and provide a smoother onboarding experience for merchants.

MTOT Disc Benefits

Enhancing the efficiency of merchant onboarding processes, understanding the benefits of MTOT Disc is crucial for businesses aiming to optimize payment processing operations. MTOT Disc, short for Merchant Turnover Discount, operates on a pricing model tied to a merchant's transaction turnover. By offering discounts based on transaction volume and value, this model incentivizes merchants to increase their transaction volumes, leading to potential cost savings. This dynamic pricing structure provides flexibility and encourages growth in transaction volumes, ultimately benefiting both the merchant and the payment processor. Implementing MTOT Disc can lead to a more cost-effective payment processing strategy, making it a valuable tool for businesses looking to maximize their financial efficiency.

| Benefits of MTOT Disc | |

|---|---|

| Cost Savings | Discounts based on transaction volumes |

| Incentivizes Growth | Encourages merchants to increase transaction volumes |

| Flexible Pricing | Dynamic pricing structure that adapts to transaction turnover |

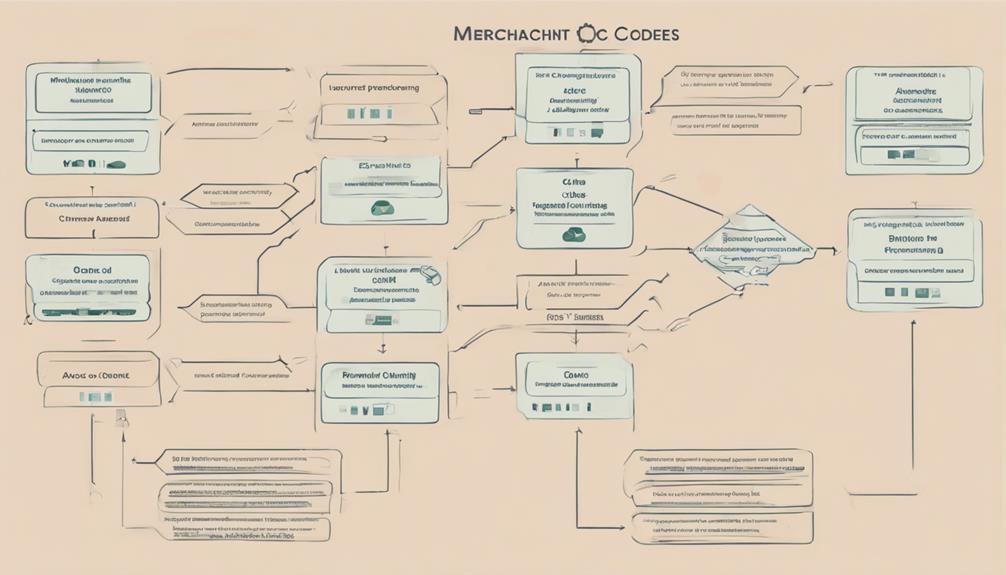

Importance of MCC Codes

MCC codes, short for Merchant Category Codes, play a vital role in the payment processing industry. These four-digit numbers categorize businesses based on the products or services they provide.

Understanding MCC codes is essential for ensuring compliance and accurately assessing risk levels in automated onboarding processes.

MCC Code Basics

Understanding the significance of MCC codes is fundamental for efficient and secure payment processing. MCC codes, or Merchant Category Codes, play a vital role in categorizing businesses based on the goods or services they offer. This classification helps payment processors evaluate risk levels associated with merchants, enabling them to set appropriate processing fees. Each business is assigned a unique MCC code aligning with their primary industry. By utilizing MCC codes, payment processors can accurately categorize transactions, monitor merchant activities, and enhance fraud prevention measures. This systematic approach ensures compliance and effective risk management in the payment processing ecosystem.

| Merchant Applications | MCC Codes | Payment Processing |

|---|---|---|

| Streamlined Processes | Risk Assessment | Fraud Prevention |

| Industry Classification | Fee Determination | Transaction Categorization |

| Compliance Assurance | Unique Identification | Risk Management |

MCC Code Compliance

In ensuring regulatory compliance and mitigating risks, adherence to MCC codes is paramount in the realm of payment processing. Understanding the importance of MCC codes aids in efficient risk assessment, accurate categorization, and overall compliance. Here's why MCC code compliance is crucial:

- Risk Assessment: MCC codes provide insights into the nature of a merchant's business, allowing payment processors to evaluate the associated risks more effectively.

- Categorization: Proper adherence to MCC codes ensures transactions are accurately categorized, enabling financial institutions to monitor and track different types of transactions with precision.

- Compliance: Compliance with MCC codes is essential for meeting regulatory requirements and maintaining a secure payment processing environment, safeguarding against potential fraudulent activities.

Simplifying MID Numbers

Simplification of MID numbers enhances efficiency and accuracy in payment processing. MID numbers, or Merchant Identification Numbers, are unique identifiers assigned to each merchant account for tracking transactions. By simplifying MID numbers, we can streamline payment processing and improve operational efficiency.

Understanding these numbers is crucial for effectively managing merchant accounts and payments. With simplified MID numbers, the process of linking transactions to specific merchants becomes more straightforward, reducing the chances of errors and enhancing overall accuracy.

Efficiently handling MID numbers allows for smoother tracking of transactions, enabling a more organized approach to payment processing. This simplification not only saves time but also ensures that payments are correctly attributed to the respective merchants.

Enhancing Payment Processing Efficiency

To boost efficiency in payment processing, we implement automated onboarding procedures to streamline operations and enhance speed. By automating the merchant application process, we can expedite approvals and setup for payment acceptance. This automation also enhances data security and compliance by streamlining verification processes for merchants. Additionally, it aids in expanding payment options for eCommerce businesses by simplifying onboarding procedures.

- Quicker Approvals: Automated onboarding reduces manual tasks, leading to quicker merchant application approvals.

- Enhanced Security: Automation helps in safeguarding data and ensures compliance by automating verification processes.

- Diverse Payment Options: By simplifying onboarding procedures, businesses can easily expand their payment options to cater to a wider customer base.

Implementing these automated processes minimizes delays in processing merchant applications, ultimately improving customer satisfaction and fostering stronger relationships.

Compliance for High-Risk Merchants

Transitioning from streamlining payment processing operations, we now address the critical aspect of compliance for high-risk merchants in the realm of financial transactions and security measures. High-risk merchants, due to their elevated financial risk, encounter stringent compliance regulations aimed at safeguarding against fraud, money laundering, and other financial crimes. To navigate these regulations effectively, high-risk merchants must automate their onboarding processes and implement robust Know Your Customer (KYC) procedures. These measures involve thorough verification of identities, ongoing monitoring, and adherence to industry-specific compliance requirements.

Compliance for high-risk merchants isn't a one-time task but an ongoing commitment to maintaining a secure and trustworthy payment processing environment. The level of compliance required may vary based on the industry in which the merchant operates and the volume of transactions processed. By prioritizing compliance, high-risk merchants can establish credibility, mitigate risks, and build trust with payment processors and customers alike. Compliance isn't just a box to tick but a cornerstone of operational excellence in the financial services industry.

Streamlining Application Process

We can enhance the merchant experience by simplifying form fields and enabling e-signatures. This approach reduces the time spent on filling out lengthy applications and speeds up the approval process.

Simplify Form Fields

Simplifying form fields in the application process enhances user experience by reducing cognitive load and increasing completion rates. When designing onboarding forms, consider the following to streamline the process effectively:

- Essential Information Only: Include necessary fields like name, contact details, and payment information to expedite completion.

- Clear Instructions: Provide concise guidance on each form field to eliminate confusion and errors.

- Progress Indicators: Incorporate visual cues to show applicants how far they're in the process, motivating them to complete the form.

Enable E-Signatures

Enabling E-Signatures optimizes the application process by streamlining document signing procedures for merchants. By allowing digital signatures, this technology eliminates the hassle of physical paperwork and accelerates the onboarding timeline.

The enhanced security measures of E-Signatures guarantee the integrity and authenticity of documents, instilling confidence in the process. Integration of E-Signatures also minimizes manual errors, boosting efficiency when processing merchant applications.

Automated E-Signatures contribute to an improved onboarding experience, offering a seamless and convenient process for merchants. Embracing this technology not only simplifies the application process but also sets a precedent for a more streamlined and secure method of handling merchant applications.

Reducing Upfront Costs

By automating onboarding processes, businesses can significantly reduce upfront costs associated with payment processing. This streamlined approach not only saves time but also cuts down on expenses related to manual labor and merchant account setup. Here are three ways automated onboarding helps in reducing upfront costs:

- Efficient Application Process: Automated onboarding streamlines the application process, eliminating the need for manual data entry and verification. This reduces the time and resources required for setting up merchant accounts.

- Minimized Manual Labor: By automating data collection and verification processes, businesses can minimize the need for manual labor, resulting in cost savings associated with human resources.

- Resource Optimization: Reducing upfront costs through automated onboarding allows businesses to allocate resources more efficiently, enhancing cost-effectiveness and operational efficiency in payment processing.

Automating onboarding processes is a strategic move towards optimizing efficiency and reducing costs in payment processing operations.

Optimizing Credit Card Payment Acceptance

Automated onboarding's role in reducing upfront costs seamlessly leads to optimizing credit card payment acceptance for merchants. By leveraging automated onboarding processes, merchants can swiftly onboard new hires and expand their online channels to apply for credit card payment acceptance, enhancing their revenue streams efficiently.

This seamless automated system not only accelerates the process but also ensures accurate completion of compliance requirements, saving time and resources. Additionally, by promptly providing merchants with Merchant Category Code (MCC) codes and Merchant Identification (MID) numbers, automated onboarding simplifies the merchant account setup process, facilitating quicker access to credit card payment acceptance.

This optimized approach enables merchants to enhance their payment options swiftly and effectively, catering to the evolving needs of their customers while maintaining control and efficiency in their operations.

Frequently Asked Questions

How Do You Automate Customer Onboarding Process?

To automate customer onboarding, we utilize software for streamlined setup and activation. This speeds up registering new customers for payment services, reduces errors, and ensures a consistent experience. It improves efficiency, saves time, and enhances satisfaction.

What Is an Automated Onboarding Process?

Automated onboarding is a streamlined system that accelerates account opening for merchants. It categorizes merchants based on risk levels for credit card acceptance. High-risk merchants undergo more stringent regulations. It enhances payment options and saves time by auto-filling crucial data.

What Is Payment Onboarding?

Payment onboarding is our gateway to processing transactions. It involves collecting data, verifying identities, and managing risks. Streamlining this process with automation enhances efficiency and reduces costs. It's the key to expanding payment options.

What Is the KYC Process for Merchant Onboarding?

Verifying merchant identity, financial history, and legitimacy is crucial. KYC process requires documentation like ID proofs and financial statements. It aids in preventing fraud and complying with regulations. We must complete it for risk management.

How Can Automated Onboarding Improve Efficiency in Payment Processing?

Automated payment processing systems can greatly improve efficiency in onboarding by streamlining the entire process. With automated systems, new payment accounts can be quickly and accurately set up, reducing human error and enhancing overall speed. This efficiency ultimately leads to faster and more reliable payment processing for businesses and customers alike.

Conclusion

In conclusion, automated onboarding for payment processing offers numerous benefits, including:

- Streamlining the application process

- Reducing upfront costs

One interesting statistic to note is that businesses using automated onboarding experience a 30% increase in efficiency, allowing them to focus on growth and profitability.

By leveraging technology to simplify merchant onboarding, businesses can optimize their credit card payment acceptance and stay ahead in the competitive payment processing industry.