Crafting a thorough market garden business plan requires several key steps: establishing a clear vision, conducting extensive market research, strategically selecting crops, effectively engaging with customers, meticulously planning finances, and prioritizing sustainability. It is crucial to begin with a well-defined vision to drive long-term success. Completing detailed market research will aid in better understanding your competitors and target audience. Choose profitable crops that are suitable for your region and manage them carefully. Engage customers through loyalty programs and utilize social media to effectively reach them. Carefully plan your finances to support both growth and stability. Implementing sustainable practices is essential for long-term success. Each of these steps plays a critical role in the success of a thriving market garden business. Keep in mind that there are more insights to uncover on your path to success in the market garden industry.

Key Takeaways

- Identify production and business risks for comprehensive risk management.

- Develop financial plans with cash flow projections for sustainability.

- Set clear vision and goals to guide business growth.

- Conduct thorough market research for customer engagement strategies.

- Select and manage crops based on market demand and sustainable practices.

Market Garden Business Plan Overview

Crafting my market garden business plan begins with understanding the all-encompassing overview of what it entails. Market gardening business plans encompass various essential components, including risk management and cash flow projections. When starting on this journey, it's important to contemplate the risks that may impact the business.

Risk management in a market gardening business plan involves identifying potential production risks such as weather fluctuations, pest infestations, or crop failures. Additionally, managing business risks like market competition, regulatory changes, or financial uncertainties is essential for long-term sustainability.

Cash flow projections play a significant role in ensuring the financial health of the market garden business. These projections cover income and expenses over a specified period, usually five years, aiding in budget planning and aligning financial goals with the overall business strategy. By accurately forecasting cash flow, market garden entrepreneurs can make informed decisions, secure investments, and steer their business towards profitability and growth.

Properly addressing risk management and cash flow projections in the business plan sets a solid foundation for success in the competitive market gardening industry.

Defining Your Business Vision

Crafting a business vision is essential for setting the direction of your market garden business. By clearly defining your vision, you can align your goals and make informed decisions.

This vision acts as a roadmap, guiding your journey towards success.

Vision Clarity

Envisioning the perfect day in the future of my market garden business involves vividly describing the ideal scenario, encompassing activities, people, decisions, and surroundings.

- Waking up to the gentle sounds of birds chirping, with the sun peeking over the horizon, promising a day of growth and abundance.

- Walking through rows of vibrant, flourishing plants, each leaf glistening with morning dew, and the air filled with the earthy scent of fresh produce.

- Engaging with a community of loyal customers, their smiles reflecting satisfaction with the quality and care put into every harvest.

- Making strategic decisions to expand operations sustainably, with a team of dedicated employees working harmoniously towards shared goals.

- Surrounded by nature's beauty, feeling a profound sense of fulfillment and purpose as my market garden business thrives, guided by a clear and inspiring vision.

Goal Setting

Defining my market garden business vision involves setting clear goals that serve as a roadmap for future success. By envisioning a perfect day in the future, I can detail activities, people, decisions, and surroundings that align with my mission and goals. This vision will guide decision-making and help set projects and tasks for the business. A well-defined vision provides direction, aligns with personal goals, and ensures long-term success and sustainability. Crafting a vision acts as a roadmap for the market garden business journey, guiding planning and decision-making processes. My business vision is a key component in setting clear goals and targets, shaping the future trajectory effectively.

| Vision | Mission | Goals |

|---|---|---|

| Envisioning a perfect day in the future | Guiding decision-making and setting projects | Setting clear targets for success |

| Detailing activities, people, decisions, and surroundings | Aligning with personal goals for sustainability | Shaping the business's future trajectory |

| Providing direction and ensuring long-term success | Guiding planning processes | Serving as a roadmap for the business journey |

Market Research and Analysis

Conducting thorough market research and analysis is a foundational step in developing a successful market garden business plan. Market research helps in understanding the landscape within which your business will operate. It involves identifying target customers, studying competitors, and analyzing market trends.

To effectively conduct market research and analysis, consider the following:

- Identify Target Customers: Understanding the demographics, buying behaviors, and preferences of your potential customers is vital for tailoring your offerings.

- Analyze Competition: Researching competitors' strengths and weaknesses can provide insights into how to differentiate your market garden business.

- Study Market Demand: Evaluating market demand, pricing strategies, and distribution channels is essential for meeting customer needs effectively.

- SWOT Analysis: Conducting a SWOT analysis helps in identifying your business's strengths, weaknesses, opportunities, and potential threats in the market.

- Trend Analysis: Keeping abreast of current market trends can help in adapting your business strategies to meet evolving customer demands.

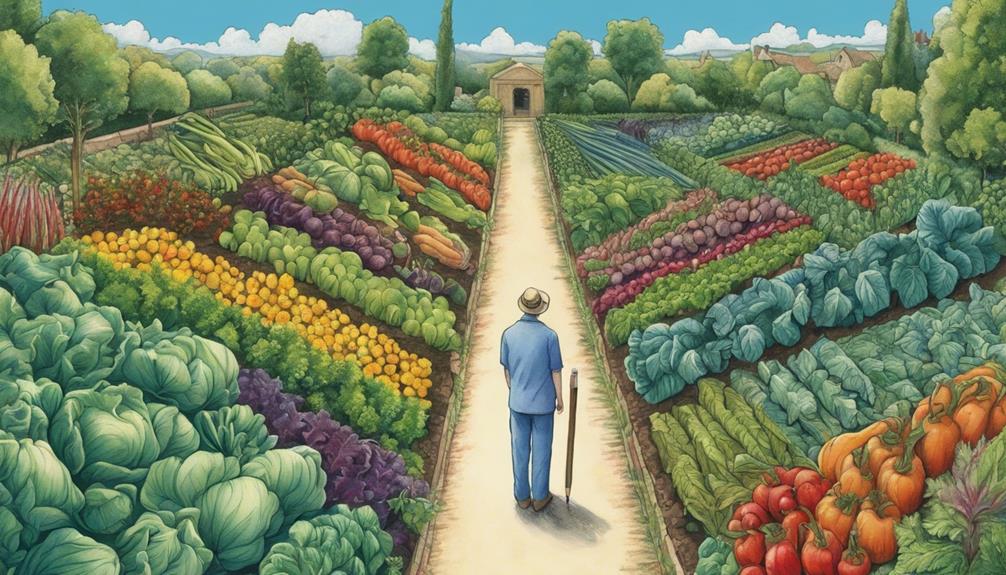

Crop Selection and Management

When planning a market garden business, it's vital to carefully select crops based on factors like market demand and profitability.

Managing crop rotations is key for maintaining soil health and preventing diseases.

Implementing integrated pest management strategies helps minimize chemical use and guarantees a healthy harvest.

Crop Variety Selection

Choosing crop varieties customized to the specific environmental conditions and market demands is crucial for the success of a market garden business. When selecting crop varieties for my garden, I consider several key factors:

- Local Climate: I choose crops that thrive in my region's specific climate to guarantee ideal growth and yield.

- Soil Conditions: Understanding my soil's composition helps me select crops that will flourish in that environment.

- Market Demand: I pay close attention to what customers in my area prefer, ensuring my crops align with market trends.

- Yield Potential: I select varieties known for high yields to maximize profitability.

- Disease Resistance: Opting for varieties with natural resistance to common diseases reduces the need for chemical interventions, promoting sustainable practices.

Pest Control Strategies

In my market garden business, I prioritize implementing pest control strategies through crop selection and management to guarantee sustainable and organic practices. By selecting pest-resistant crop varieties, I aim to reduce the need for chemical interventions, promoting a healthier market garden environment.

Implementing crop rotation strategies disrupts pest life cycles organically, preventing infestations without harmful chemicals. Utilizing physical barriers such as row covers provides a protective shield against pests, eliminating the necessity for chemical pesticides.

Introducing beneficial insects like ladybugs and lacewings serves as a natural pest control method, maintaining the organic integrity of the market garden. Regular monitoring of pest populations and promptly addressing outbreaks are essential steps to prevent significant crop damage, fostering a thriving and sustainable market garden ecosystem.

Soil Health Management

To maintain peak soil health and fertility in my market garden, strategic crop selection and management practices are essential components. When considering soil fertility, crop rotation plays a crucial role in preventing depletion and nutrient deficiencies.

Additionally, cover crops contribute substantially to soil conservation, weed suppression, and the maintenance of soil structure. Intercropping different plant species can enhance biodiversity within the garden while also reducing pest pressure naturally.

Embracing organic farming practices such as composting and minimal tillage not only fosters healthier soil but also improves its quality over time. By integrating these methods into my market garden plan, I aim to cultivate a sustainable and thriving ecosystem for my crops to flourish.

Customer Engagement Strategies

Implementing customer engagement strategies like loyalty programs and exclusive offers is essential for retaining and attracting customers to your market garden business. Utilizing social media platforms such as Facebook, Instagram, and Twitter can help you connect with your audience, share updates about your products, and engage in conversations with customers. Email marketing is another powerful tool to communicate promotions, upcoming events, or gardening tips directly to your customers' inboxes.

In addition to digital strategies, offering educational workshops, farm tours, or tasting events can create memorable experiences for your customers and strengthen their connection to your brand. Collecting feedback through surveys or comment cards allows you to understand your customers' preferences better and tailor your services to meet their needs. Implementing a customer referral program can also incentivize your existing customers to bring in new business, expanding your customer base through word-of-mouth recommendations.

Financial Planning and Budgeting

Crafting a solid financial plan and budget is vital for the long-term success of your market garden business. To guarantee that your financial planning and budgeting process is effective, consider the following key points:

- Projected income and expenses: Forecasting your income and expenses for the next five years is essential to understanding the financial health of your market garden business.

- Budget and Cash Flow Planner: Developing a Budget and Cash Flow Planner can assist you in effectively managing your finances and allocating resources efficiently.

- Adjusting figures: Regularly adapting your income and expense figures is necessary to assess profitability accurately and make informed financial decisions.

- Cash flow drivers: In market gardening, cash flow is largely influenced by your marketing strategies and plans for business expansion.

- Alignment with business plan: Ensuring that your cash flow projections align with the overall goals and objectives outlined in your business plan is crucial for achieving long-term success.

Sustainability Practices and Growth Strategies

As we focus on enhancing the sustainability of our market garden business and implementing growth strategies, incorporating sustainable farming practices and exploring renewable energy options are key steps towards long-term success. By implementing practices such as crop rotation, cover cropping, and composting, we can improve soil health and productivity while minimizing the need for chemical pesticides through integrated pest management techniques. These efforts not only promote natural pest control methods but also contribute to the production of organic food, appealing to a market increasingly valuing healthy and sustainable options. Additionally, introducing water conservation measures like drip irrigation systems and rainwater harvesting can help us efficiently manage water resources, making our small farm more profitable in the long run. Exploring renewable energy sources such as solar panels or wind turbines not only reduces our reliance on fossil fuels but also lowers operational costs, further enhancing our sustainability. Collaboration with local communities to promote environmental stewardship and sustainable agriculture practices can also foster growth and support our commitment to sustainable farming.

| Sustainability Practices | Growth Strategies |

|---|---|

| Organic farming methods | Market expansion |

| Integrated pest management | Community partnerships |

| Water conservation measures | Diversification of crops |

Frequently Asked Questions

How Profitable Is Market Gardening?

Market gardening can be highly profitable, with revenue potential exceeding $100,000 per acre. By focusing on direct sales channels like CSA operations and effective marketing strategies, profit margins of around 45% are achievable. Initial start-up costs may be around $40,000, but the annual revenue can range from $60,000 to $100,000 per acre.

With a keen eye on reducing operating costs, market gardening proves to be a financially viable and profitable business venture.

What Is a Market Garden Structure?

A market garden structure is like a finely tuned orchestra, harmoniously blending intensive cultivation of high-value crops on a small scale. It's a commercial venture focused on growing vegetables, fruits, flowers, and plants for profit.

Employing biointensive methods, these gardens aim for maximum productivity. Strategies like CSA operations and farmer's markets are common.

Efficiency in farm design, detailed crop planning, and meeting customer preferences are key to profitability in this setup.

How Much Does It Cost to Start a Market Garden?

Starting a market garden can cost between $20,000 to $50,000 initially, covering expenses like equipment, infrastructure, labor, and ongoing operational costs.

Basic tools may add up to around $500, while specialized equipment like irrigation systems can range from $1,000 to $5,000. Infrastructure such as greenhouse construction could require an additional $5,000 to $10,000.

Labor expenses average $10,000 to $20,000 annually, with operational costs reaching $10,000 to $20,000 per year.

What Is an Example of Market Gardening?

An example of market gardening is Les Jardins de La Grelinette in Quebec, Canada. This successful 10-acre micro-farm generates over $100,000 per acre in revenue. By following bio-intensive growing methods on 1.5 acres, they've achieved a profit of $65,000 in 2013, with expenses of $75,000.

Their revenue comes from CSA operations, farmers markets, and restaurants/grocery stores, showcasing a sustainable business model that emphasizes high productivity on small plots of land.

Conclusion

To sum up, crafting a market garden business plan requires careful consideration of various factors such as:

- Vision

- Market research

- Crop selection

- Customer engagement

- Financial planning

- Sustainability practices

- Growth strategies

By implementing these steps effectively, you can set yourself up for success in the market gardening industry.

Remember, attention to detail and strategic planning are key to building a thriving business that meets the needs of both your customers and your bottom line.