In the payment processing sector, Epic distinguishes itself with features like real-time transaction processing for immediate verification, secure payment gateways with encrypted transactions, seamless integration with various payment methods, robust fraud protection measures, comprehensive reporting and analytics tools, scalability for businesses, and a user-friendly interface. These features are meticulously designed to enhance efficiency, security, and customer satisfaction, providing a comprehensive solution for diverse payment needs.

Key Takeaways

- Real-time transaction processing for immediate verification and control.

- Secure payment gateways with encrypted transactions and multiple processor integration.

- Detailed reporting and analytics tools for customized insights.

- Customizable payment solutions tailored to healthcare provider needs.

- Excellent customer support with dedicated online and in-person assistance.

Real-Time Transaction Processing

In our modern digital age, Epic Payment Processing stands out with its real-time transaction processing feature, ensuring immediate verification and approval of payments. This capability allows us to monitor financial transactions efficiently, giving us control and visibility into our cash flow. With real-time processing, errors and delays are minimized, enhancing our financial operations' accuracy and efficiency. It provides us with the peace of mind that our payments are processed swiftly and accurately, contributing to improved financial management.

Moreover, the real-time transaction processing feature in Epic Payment Processing allows us to track payments every day, offering transparency and visibility into our financial transactions. This feature empowers us to manage our finances effectively, knowing that our transactions are being processed with precision. With Epic Payment Processing, our rights reserved are protected, and our company registration number is secure, ensuring a smooth and reliable payment processing experience.

Secure Payment Gateways

Transitioning from real-time transaction processing, Epic Payment Processing ensures secure payment gateways for safe and encrypted transactions, offering users flexibility and protection in their payment methods. Our system integrates with various payment processors, providing a range of options for users to accept credit card payments, electronic funds transfers, and other methods securely. By complying with industry standards for data security and protecting sensitive information, we prioritize the safety of all transactions. Our commitment to secure payment gateways means that users can have peace of mind knowing that their financial information is safeguarded. To illustrate our dedication to security, below is a table showcasing the key features of our secure payment gateways:

| Secure Payment Gateways Features | Benefits |

|---|---|

| Safe and encrypted transactions | Ensures data protection |

| Integration with various payment processors | Offers flexibility |

| Compliance with industry standards | Guarantees security |

| Support for multiple payment methods | Enhances user convenience |

Seamless Integration With Payment Methods

Our system effortlessly incorporates a variety of payment methods, such as credit cards, debit cards, and mobile wallets, ensuring seamless transactions for users. This means that patients can choose the payment option that suits them best, whether it's using their preferred credit card or mobile payment app. By catering to diverse payment preferences, we enhance the convenience and accessibility of the payment process. Additionally, our system's compatibility with these different methods streamlines the transaction experience, making it quick and straightforward.

When patients engage with the Epic Payment Processing system through the patient portal, they can securely complete their transactions online. The encryption and tokenization features provide a safeguard for sensitive data, reassuring both patients and healthcare providers of the protection of their information. This seamless integration not only benefits users by offering a range of payment choices but also ensures that transactions are processed efficiently and securely.

Robust Fraud Protection Measures

Implementing cutting-edge security protocols, Epic Payment Processing fortifies its system against fraudulent activities through a range of advanced measures. These measures are designed to instill confidence in users and provide them with a sense of control over their financial transactions.

Here are four ways Epic Payment Processing ensures robust fraud protection:

- Encryption and Tokenization: By encrypting sensitive data and replacing it with tokens, Epic Payment Processing adds an extra layer of security to prevent unauthorized access.

- Real-Time Monitoring: Utilizing machine learning algorithms, the system continuously monitors transactions in real-time, swiftly detecting any suspicious activity and mitigating potential risks.

- Compliance with Industry Standards: Epic's fraud protection measures adhere to strict industry regulations, ensuring that payment information is safeguarded according to the highest security standards.

- Instant Alerts and Notifications: Users receive real-time alerts and notifications about any unusual payment behavior or security breaches, empowering them to take immediate action and maintain control over their financial security.

Detailed Reporting and Analytics Tools

Epic Payment Processing enhances user experience through its comprehensive suite of detailed reporting and analytics tools, empowering users to efficiently track payment trends and optimize financial performance. With these tools, users can generate customizable reports in real-time, offering valuable insights into payment processing activities and overall financial health.

The analytics features provided by Epic Payment Processing are essential for identifying payment discrepancies, monitoring billing cycles, and refining revenue collection strategies. Moreover, the advanced data visualization capabilities integrated into the platform enable users to interpret complex financial data with ease, facilitating informed decision-making for their organization.

Customizable Payment Solutions

Epic's customizable payment solutions offer healthcare organizations flexibility with payment options, tailored plans, and personalized solutions. These features cater to the specific needs of each organization, allowing for seamless integration and efficient payment management.

Flexible Payment Options

Our customizable payment solutions at Epic Payment Processing cater to the specific needs of healthcare providers, offering a range of flexible options to streamline payment collection processes. When it comes to managing payments, we understand the importance of having control and choices.

Here are four ways our flexible payment options empower healthcare providers:

- Credit Card Payments: Seamlessly accept payments via credit cards, providing convenience to both patients and staff.

- Installment Plans: Customize payment schedules to suit the financial capabilities of patients, enhancing affordability.

- Automatic Payment Schedules: Set up automatic payments for recurring bills, ensuring timely transactions without manual intervention.

- Integration with Payment Gateways: Easily integrate with various payment processors for smooth and efficient transactions, giving you the freedom to choose the best fit for your organization.

Tailored Payment Plans

Tailored payment plans at Epic Payment Processing are designed to meet the specific needs of healthcare organizations and their patients, offering customizable solutions to enhance financial flexibility and convenience. These plans enable healthcare providers to create personalized payment schedules, amounts, and methods tailored to individual patient situations. By allowing flexibility in setting up payment arrangements based on factors like insurance coverage, treatment costs, and patient preferences, Epic Payment Processing empowers healthcare facilities to streamline the payment process effectively. This approach not only improves patient satisfaction by offering convenient payment options but also aims to boost patient engagement, reduce financial barriers to care, and enhance revenue cycle management for healthcare organizations.

| Benefits of Tailored Payment Plans | |

|---|---|

| Enhances financial flexibility | Streamlines payments |

| Customized solutions | Increases patient satisfaction |

| Improves revenue cycle management |

Personalized Payment Solutions

In providing personalized payment solutions, healthcare organizations can tailor billing processes to individual needs and preferences, enhancing efficiency and patient satisfaction. Epic's customizable payment solutions offer a range of benefits for both providers and patients:

- Tailored Payment Plans: Create personalized payment plans based on patients' financial situations.

- Automatic Reminders: Set up automatic reminders for upcoming payments to ensure timely transactions.

- Multiple Payment Options: Offer various payment methods to accommodate diverse patient preferences.

- Seamless Integration: Epic's payment processing system seamlessly integrates with EHR software for a comprehensive financial management solution.

Excellent Customer Support

With dedicated online support and in-person follow-up for larger accounts, Epic's customer service stands out for its attentiveness and assistance in navigating their payment processing system. This level of support is crucial for users who value control and reliability in their payment processing solutions.

Epic goes beyond just offering a system by providing optimization support for larger accounts, ensuring a seamless integration process and maximizing the utility of their payment features. The company's commitment to strong customer support and training resources further enhances the user experience, offering assistance with any issues or questions that may arise.

Additionally, Epic's browser-based system eliminates the need for software installation, making it easy for users to access and utilize the payment processing features. For users of Apple devices, Epic offers dedicated apps tailored to different iOS devices, guaranteeing a smooth and efficient payment processing experience across various platforms.

This comprehensive support network reflects Epic's dedication to empowering users and ensuring their payment needs are met with precision and care.

User-Friendly Interface

Navigating Epic Payment Processing's user-friendly interface is a breeze, with clear prompts and intuitive design elements that streamline payment processing tasks. The system is tailored for ease of use, offering a seamless experience for both staff and patients. Here are four key features that make the user interface stand out:

- Intuitive Design: The interface is thoughtfully crafted to guide users effortlessly through payment processing steps.

- Clear Prompts: Users are provided with straightforward instructions, eliminating any confusion during transactions.

- Accessible Information: Easily access and manage payment details, transactions, and reports within the system.

- Customizable Options: Tailor the interface to match specific payment processing needs and preferences for enhanced control.

With these features, Epic Payment Processing empowers users to efficiently navigate the system, ensuring a smooth and hassle-free payment processing experience.

Scalability for Growing Businesses

As businesses grow, the demand for payment processing also increases. Epic Payment Processing's scalability feature allows businesses to handle a higher volume of transactions without performance issues.

This ensures that companies can expand their operations smoothly and efficiently.

Flexible Pricing Options

Flexibility in pricing options at Epic Payment Processing empowers businesses to tailor their payment solutions to accommodate growth seamlessly. Here are four key benefits of the flexible pricing options offered:

- Customizable Solutions: Businesses can adjust pricing based on transaction volume and specific needs, ensuring cost-effectiveness.

- Variety of Models: Choose from flat-rate pricing, interchange-plus pricing, or subscription-based pricing to align with financial goals.

- Transparent Pricing: Epic Payment Processing maintains clarity with no hidden fees, aiding businesses in budgeting effectively.

- Scalability: Easily adapt payment processing solutions to meet changes in sales volume or seasonal demands, providing control over costs and growth.

Easy Integration Process

With its seamless integration process, Epic Payment Processing caters to the scalability needs of growing businesses, ensuring a smooth transition as operations expand. The ease of integrating this system with existing platforms minimizes disruptions to daily workflows.

Businesses can effortlessly link Epic Payment Processing with other Epic modules or third-party applications, enhancing their operational efficiency. Moreover, the integration with Epic EHR facilitates the seamless flow of financial data between payment processing and patient records. This flexibility in integration makes Epic Payment Processing a robust solution suitable for businesses of all sizes, providing the adaptability necessary for evolving needs.

Multi-Currency Support

Our payment processing system seamlessly handles transactions in multiple currencies to support global business operations. With Epic Payment Processing's multi-currency support, businesses can truly expand their reach and cater to a diverse customer base.

Here are some key points to consider:

- Tailored Currency Preferences: Users have the flexibility to set specific currency preferences based on their business needs and the regions they operate in, ensuring transactions align with their target markets.

- Real-Time Currency Conversion: The system automatically converts currency rates in real-time, guaranteeing accurate and up-to-date transactions regardless of fluctuating exchange rates.

- Global Expansion: Multi-currency support empowers businesses to venture into new international markets with ease, opening doors to new revenue streams and customer opportunities.

- Detailed Reporting: Detailed breakdowns of transactions in various currencies are available for easy tracking and analysis, providing insights into global sales performance and trends.

Epic Payment Processing's robust multi-currency capabilities offer control and efficiency for businesses operating on a global scale.

Recurring Billing Options

Epic Payment Processing offers convenient automated payment schedules and customizable billing cycles for efficient payment management. Users benefit from reduced manual intervention and improved cash flow by setting up recurring payments.

With various frequency options like monthly, quarterly, or annually, the system ensures timely and accurate transactions to enhance convenience for both providers and patients.

Automated Payment Schedules

Implementing automated payment schedules significantly streamlines billing processes for healthcare providers using Epic Payment Processing. This feature allows users to set up recurring payment plans with ease, reducing manual intervention and the risk of human error.

Here are four reasons why automated payment schedules are beneficial for healthcare organizations:

- Efficiency: Save time and effort by automating recurring payments, ensuring timely collections without constant manual oversight.

- Customization: Tailor payment schedules to meet individual patient needs, providing flexibility and accommodating various payment preferences.

- Financial Stability: Improve revenue management by efficiently tracking and managing recurring payments, enhancing the organization's financial health.

- Patient Satisfaction: Enhance the patient experience by offering convenient payment options, reducing stress associated with payments, and ultimately increasing satisfaction levels.

Customizable Billing Cycles

Customizable billing cycles in Epic Payment Processing enhance efficiency by allowing users to tailor recurring billing options to their specific needs. With the ability to schedule and automate payments for patients, the billing process becomes streamlined, saving time and improving accuracy.

Epic Payment Processing offers flexibility in setting up various billing frequencies, such as monthly, quarterly, or annually, catering to different payment preferences. By customizing billing cycles, manual intervention is reduced, errors are minimized, and payments are made consistently and on time.

Healthcare providers can leverage these features to enhance revenue management and boost the financial health of their practice. The control over billing cycles empowers users to optimize their payment processes according to their unique requirements.

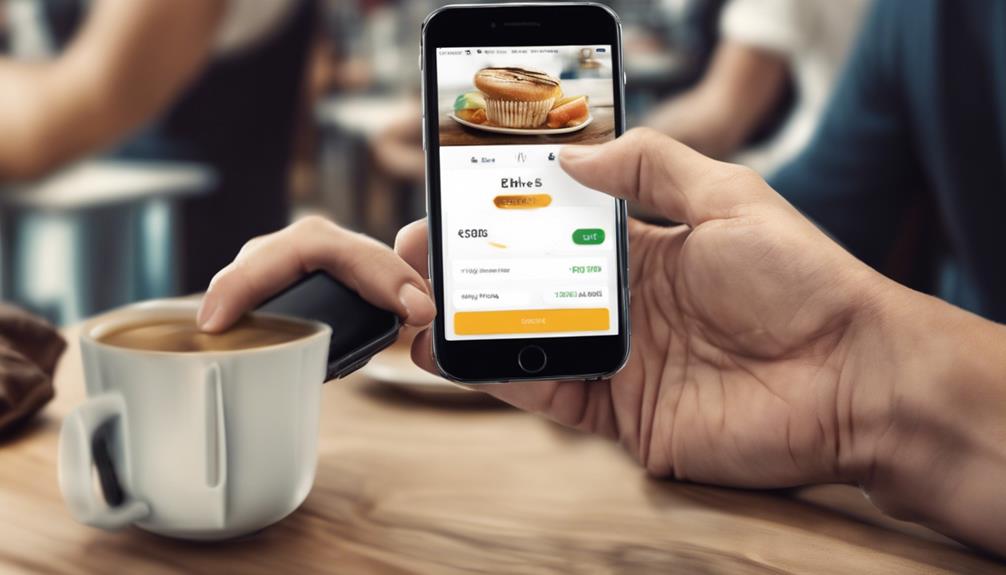

Mobile Payment Capabilities

Enhancing convenience and efficiency, the mobile payment capabilities offered by Epic Payment Processing allow healthcare providers to accept payments on-the-go using smartphones or tablets. This feature not only simplifies payment collection but also ensures the security of patient information during transactions. Here are four ways in which Epic's mobile payment capabilities can benefit healthcare providers:

- User-Friendly Interface: The mobile payment feature is designed for ease of use, allowing staff to quickly process payments without complexity.

- Enhanced Efficiency: Healthcare professionals can conveniently collect payments from patients anywhere within the facility, reducing wait times and improving overall efficiency.

- Streamlined Billing Process: By integrating seamlessly with Epic's payment processing system, the mobile capabilities help streamline the billing process and minimize administrative burdens.

- Comprehensive Solution: Epic's mobile payment capabilities provide a comprehensive solution for managing financial transactions in healthcare settings, offering control and convenience in payment collection.

Frequently Asked Questions

What Are the Benefits of Using Epic?

Using Epic brings benefits like seamless integration with EHR, secure payment options, real-time processing, and customizable reporting. It ensures efficiency, security, and compliance, enhancing revenue cycle management. Epic simplifies payment processing for us.

What Is the Epic Billing System?

The Epic billing system efficiently handles electronic billing and claims submission, automating processes and reducing errors. It integrates with insurance payers for coverage verification and streamlined claims processing. Tools for denials, collections, and patient payments are included.

What Are the Disadvantages of Epic Systems?

We experience frequent downtime during backend updates with Epic Systems, impacting system availability. Updates may lack clear benefits, leading to confusion and inefficiencies in task completion. Redundant flowsheets and nonlinear note creation pose challenges for users.

What Are Epic Billing Indicators?

Epic billing indicators in healthcare are customizable markers within the EHR system. They track billing processes efficiently, like pending claims or insurance details. By managing these indicators effectively, providers can improve revenue cycle management and streamline workflows.

What Makes Fortis Payment Processing’s Features Different from Epic Payment Processing?

Fortis Payment Processing features focus on advanced security measures, seamless integration, and customizable solutions to meet the specific needs of businesses. In contrast, Epic Payment Processing offers a more basic set of features without the same level of flexibility and innovation found in fortis payment processing features.

Conclusion

In conclusion, Epic Payment Processing offers a wide range of stand out features that make it a top choice for businesses.

With real-time transaction processing, secure payment gateways, and robust fraud protection measures, Epic ensures seamless integration with various payment methods.

Its scalability, multi-currency support, and recurring billing options cater to growing businesses' needs.

The detailed reporting and analytics tools, along with mobile payment capabilities, make Epic a reliable and efficient payment processing solution for all types of businesses.