When processing Visa card applications, it is essential to follow Visa Core Rules, maintain PCI DSS compliance, and improve security measures to ensure effective card management. Adhering to Visa’s guidelines not only ensures safe transactions but also helps prevent potential penalties. It is crucial to use strong encryption methods and adhere to PCI DSS standards for data protection. Keeping informed about fraud prevention techniques and industry standards is crucial for securely handling transactions. Accurate record-keeping and efficient dispute resolution processes are crucial for maintaining transaction integrity. By following these guidelines, you can ensure seamless payment processing and the protection of cardholder information. To gain a comprehensive understanding, you can learn more about the detailed aspects of Visa card management.

Key Takeaways

- Compliance with Visa Core Rules and PCI DSS is crucial.

- Secure cardholder data storage is essential for protection.

- Efficient dispute resolution procedures are vital for handling disputes.

- Maintaining PCI compliance is mandatory for data security.

- Smooth transaction processing requires strict adherence to regulations.

Visa Card Handling Application Overview

We navigate Visa card handling applications by abiding by Visa Core Rules and Product and Service Rules. As merchants, it's vital for us to guarantee compliance with the Payment Card Industry Data Security Standard (PCI DSS) to ensure secure Visa card transactions.

The PCI DSS sets forth a framework for secure handling of cardholder information, reducing the risk of data breaches and fraud. Depending on the volume of Visa transactions we process, different levels of compliance validation may apply, requiring us to undergo regular assessments to maintain a secure environment.

Additionally, participating in Visa's Technology Innovation Program can be beneficial as it rewards investments in secure technology for card handling, potentially enhancing our security measures and standing with Visa.

However, it's important to note that non-compliance with Visa regulations can result in assessments and potential penalties, underscoring the importance of strict adherence to Visa rules and industry standards for smooth card handling operations.

Visa Rules and Compliance Requirements

Ensuring compliance with Visa rules and regulations is essential for businesses to uphold secure card handling practices and meet global standards. Visa rules, governed by Visa Core Rules (VCR) and Product and Service Rules, are designed to guarantee adherence to international norms.

Complying with the Payment Card Industry Data Security Standard (PCI DSS) is vital for maintaining secure transactions and safeguarding sensitive data. Merchants must adhere to specific guidelines for Visa card acceptance, encompassing transaction limits, receipt requirements, and regulations on surcharging.

Visa also outlines detailed protocols for managing data breaches, including reporting procedures and strategies to prevent future incidents. Understanding Visa's regulations is paramount for businesses to ensure compliance, avoid penalties, and foster trust with customers.

PCI DSS Standards and Compliance

Adhering to PCI DSS standards is vital for maintaining a secure payment environment and protecting cardholder data against potential breaches. PCI DSS, which stands for Payment Card Industry Data Security Standard, encompasses 12 basic requirements within 6 categories to guarantee a secure payment ecosystem. Compliance with PCI DSS is mandatory for all entities involved in processing, storing, or transmitting cardholder data to prevent data breaches effectively. It's essential to partner with an acquirer to ensure secure transactions and adhere to the guidelines outlined by PCI DSS.

PCI DSS compliance involves addressing various aspects such as firewall configuration, password security, data encryption, and system security to safeguard cardholder data effectively. Merchants are obligated to follow PCI DSS requirements, submit compliance reports annually, and meet small merchant data security requirements to uphold secure card handling practices. By aligning with PCI DSS standards and maintaining compliance, businesses can greatly reduce the risk of data breaches and enhance overall payment security.

Secure Cardholder Data Storage

Implementing robust encryption methods is essential for safeguarding sensitive cardholder data in secure storage systems. By adhering to PCI DSS standards, organizations can guarantee the security of cardholder information and prevent data breaches. Redacting cardholder details on physical documents adds an extra layer of security, preserving confidentiality. Proper disposal techniques for stored data, such as shredding or secure erasure, are crucial to maintain data integrity and prevent unauthorized access. Minimizing the retention of cardholder data to only what is necessary reduces risks and aids in regulatory compliance with PCI DSS guidelines.

| Security Measures | Importance |

|---|---|

| Encryption methods | Essential for data security |

| Redaction techniques | Maintain confidentiality |

| Disposal procedures | Vital for data integrity |

| Minimal data retention | Reduces risks |

| Compliance with PCI DSS | Ensures regulatory adherence |

Transaction Handling Guidelines

When handling transactions, we must prioritize secure payment processing, implement fraud prevention measures, and guarantee compliance with regulations. By following these guidelines, we can safeguard sensitive information, prevent fraudulent activities, and maintain the trust of our customers.

It's essential to stay informed about the latest industry standards and consistently update our practices to meet the evolving needs of the payment processing landscape.

Secure Payment Processing

How can we guarantee the secure processing of payments while adhering to PCI DSS standards to protect cardholder data?

Secure payment processing is crucial for maintaining the integrity of transactions. By following PCI DSS guidelines, we guarantee that cardholder data is safeguarded against potential threats. Compliance with these standards is non-negotiable when handling sensitive information.

Procedures for accepting both Card Present and Card Not Present transactions must be implemented diligently to mitigate risks. Timely responses to chargebacks and effective resolution of disputed transactions are essential components of maintaining compliance.

Additionally, practices such as secure storage of cardholder data, redaction of sensitive information, and ensuring overall PCI compliance are fundamental in upholding the security of payment processing systems.

Fraud Prevention Measures

To enhance security and protect against fraudulent activities, incorporating fraud prevention measures in transaction handling guidelines is essential. Implementing Address Verification Service (AVS) can help by verifying the cardholder's address provided during transactions, while utilizing Card Verification Value (CVV) codes enhances security by requiring the three-digit code on the back of the card for online transactions.

Monitoring for unusual transaction patterns and enforcing strong password policies for online account access are additional steps that can help prevent fraud. Educating staff members on recognizing and handling potential fraud indicators is vital in preventing unauthorized transactions and safeguarding cardholder data.

Compliance With Regulations

Incorporating fraud prevention measures is fundamental to ensuring compliance with regulations in transaction handling guidelines, particularly when accepting card payments. Adhering to the Payment Card Industry Data Security Standard (PCI DSS) is essential for secure payment processing and safeguarding cardholder data.

It's important to follow specific procedures for accepting different types of card transactions, such as Card Present and Card Not Present, to meet regulatory requirements. Additionally, promptly responding to chargebacks and disputes in accordance with outlined guidelines is key.

Maintaining accurate records for transaction reconciliation and implementing proper storage practices to securely store cardholder data are crucial aspects of compliance. Ensuring that merchant locations adhere to PCI DSS standards and avoid unnecessary retention of cardholder information is vital for regulatory adherence.

Responding to Chargebacks Efficiently

When responding to chargebacks efficiently, merchants must provide compelling evidence to dispute the transaction disputes effectively. Chargebacks, initiated by cardholders disputing transactions, require merchants to adhere to specific timeframes outlined in Visa regulations.

It's essential for merchants to gather and submit convincing proof, such as purchase receipts, delivery confirmations, or any relevant customer correspondence, to challenge chargebacks successfully. Timely and thorough responses not only help prevent financial losses but also play a significant role in maintaining a positive relationship with Visa and cardholders.

Familiarizing oneself with Visa's chargeback reason codes is vital, as it provides insight into the basis of the dispute and aids in formulating a robust response. By efficiently managing chargebacks, merchants can mitigate the impact on their reputation and financial stability in the long term, ensuring compliance with Visa regulations and safeguarding their business interests.

Maintaining Accurate Transaction Records

Accurate transaction records play an important role in tracking financial activities and ensuring compliance with Visa rules. Maintaining precise records is essential for businesses that handle credit card transactions. Here are three key points to keep in mind when it comes to maintaining accurate transaction records:

- Information Security: Safeguarding Merchant Data is crucial to prevent unauthorized access or data breaches. Implementing robust security measures such as encryption and access controls can help protect sensitive transaction information.

- Detailed Documentation: Recording transaction details like date, amount, merchant name, and authorization codes is crucial for creating an audit trail. This documentation not only aids in reconciliation but also provides a clear history of transactions for reference.

- Fraud Detection: Accurate transaction records assist in detecting fraudulent activities and unusual spending patterns. By analyzing transaction data, businesses can identify potential fraud early on, mitigating financial risks and ensuring the integrity of their operations.

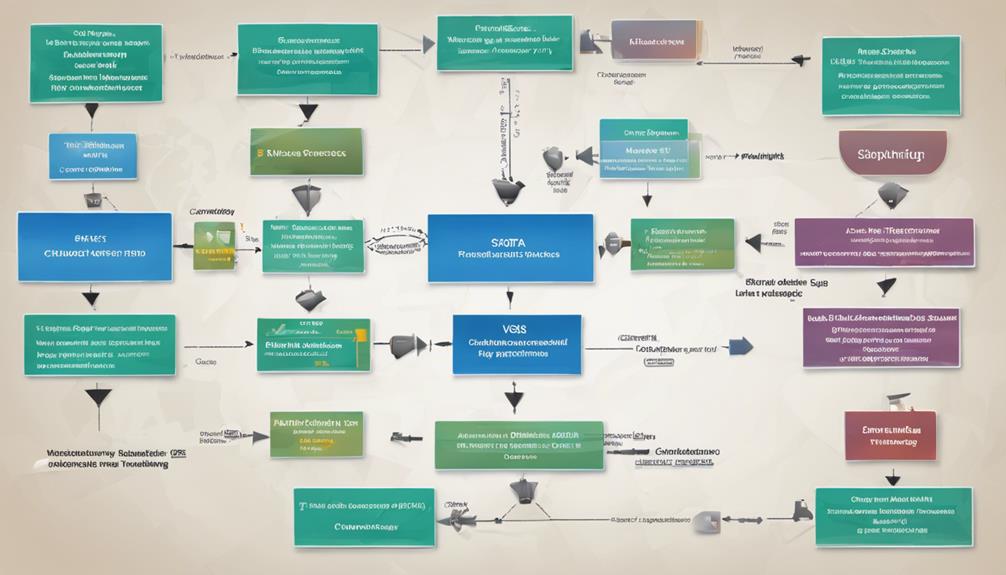

Dispute Resolution Procedures

Our approach to resolving disputes in Visa card transactions involves following specific steps to address discrepancies promptly and effectively.

When cardholders identify unauthorized transactions or errors on their Visa statements, they must report these disputes within the designated timeframes to receive resolution assistance.

It's important for merchants to respond promptly to dispute notifications and provide any necessary supporting documentation to aid in the resolution process.

Understanding Visa's chargeback reason codes is vital for effectively responding to disputes, as these codes categorize the reasons for disputes and guide the resolution process.

By familiarizing themselves with these codes, both cardholders and merchants can navigate the dispute resolution procedures more efficiently and increase their chances of reaching a favorable outcome.

Therefore, being well-versed in Visa's dispute resolution mechanisms and chargeback reason codes is fundamental for ensuring smooth and successful resolution of transaction discrepancies.

Importance of PCI Compliance

Managing Visa card transactions successfully involves guaranteeing PCI Compliance to safeguard cardholder data and prevent data breaches. PCI DSS standards play a vital role in maintaining the security of cardholder information.

Here are three key points highlighting the importance of PCI Compliance:

- Data Protection: PCI Compliance guarantees that cardholder data is handled securely, reducing the risk of data breaches that could compromise sensitive information.

- Legal Obligations: Non-compliance with PCI DSS standards can result in assessments and penalties for businesses, emphasizing the legal necessity of adhering to these regulations.

- Industry Trust: Maintaining PCI compliance not only fulfills regulatory requirements but also builds customer trust. By demonstrating a commitment to data security, businesses can enhance their reputation and credibility in the industry.

Ensuring Smooth Transaction Processing

To guarantee smooth transaction processing, understanding and adhering to Visa card handling applications is vital. Efficient card handling relies on proper training and strict adherence to Visa's rules and regulations.

Following the Data Security Standard (PCI DSS) is essential for maintaining secure transaction processing and safeguarding cardholder data. Regular audits and compliance validation are necessary to uphold the integrity of Visa card handling applications.

Implementing robust security measures and staying abreast of technological advancements are key factors in successful Visa card processing. By prioritizing PCI DSS standards and ensuring strict adherence to Visa guidelines, businesses can streamline payment processes, enhance customer satisfaction, and protect sensitive card information.

Mastery of these fundamental aspects of card handling applications is essential for businesses seeking to optimize transaction processing efficiency and maintain trust with their clientele.

Frequently Asked Questions

What Are the Core Principles of Visa?

Visa's core principles revolve around security, reliability, and convenience in payment solutions. Innovation drives technology to heighten payment experiences and guarantee secure transactions. Financial inclusion, economic growth, and a competitive marketplace are key focuses.

Upholding integrity, transparency, and regulatory compliance is vital. Customer trust, data protection, and continuous industry enhancement are prioritized.

What more could one want from a payment giant like Visa?

What Are the Requirements for a Visa Card?

To get a Visa card, you need to complete an application with personal and financial details. Meeting age requirements and having a good credit history is important.

Different types of Visa cards offer various benefits depending on the issuer and your needs. Understanding and following Visa's rules for card usage is vital.

Visa cards provide a convenient and widely accepted payment method globally for different transactions.

What Do You Need to Apply for Visa Card?

To apply for a Visa card, you'll need to be at least 18 years old and have a valid ID. Proof of income, like pay stubs or tax returns, is necessary to show you can pay charges.

A good credit score helps approval odds, with higher scores leading to better terms. Some cards have specific criteria, like student status for student cards.

Meeting requirements and giving accurate info boosts approval chances.

How Does Visa Payment Processing Work?

Visa payment processing works by encrypting cardholder information and sending it to the issuing bank for approval. Once approved, funds are transferred, and transactions are completed securely in real-time.

Merchants use point-of-sale terminals or online gateways to initiate Visa payments for goods and services. Visa's global network facilitates transactions in multiple currencies and countries, ensuring seamless payment experiences.

– What are the key legal responsibilities that Visa card handling applications must adhere to?

When handling Visa card applications, it is crucial to adhere to the legal duties of credit card processing. This includes safeguarding cardholder information, ensuring secure transactions, and complying with industry regulations. Businesses must also protect against fraud and maintain proper documentation to meet legal responsibilities in Visa card processing.

Conclusion

To sum up, managing Visa card applications is like traversing a complex maze. By ensuring adherence to Visa rules and PCI DSS standards, businesses can securely store cardholder data and process transactions smoothly.

It's essential to maintain accurate records and have a robust dispute resolution process in place. Ultimately, maintaining PCI compliance is the key to accessing the door to secure and reliable transaction processing.

Just as a skilled navigator finds their way through the maze, businesses must maneuver the Visa card handling landscape with precision and care.