Understanding how national payment processing works is crucial for navigating the complicated financial transaction landscape that drives modern economies. National payment systems play a vital role in ensuring the smooth transfer of funds and adherence to regulatory guidelines, maintaining the integrity and effectiveness of monetary transactions. By gaining insight into the various players in the process – including merchants, payment networks, and banks – as well as the technologies that enable these transactions, individuals can effectively navigate the intricate world of payment processing.

This understanding not only ensures secure fund movements but also contributes to the overall stability and growth of the economy.

Key Takeaways

- National Payment Processing facilitates seamless fund transfers overseen by the Federal Reserve System.

- Entities like merchants, payment networks, and banks are crucial for secure transactions.

- Payment processors play intermediary roles, ensuring efficient and secure batch transactions.

- Transaction security measures include encryption, PCI DSS compliance, tokenization, and multi-factor authentication.

- Payment processing technologies, credit card networks, and processors are essential for efficient national payment systems.

National Payment Processing Overview

National Payment Processing plays a crucial role in facilitating the seamless transfer of funds across the nation's financial landscape. Within this system, the Federal Reserve System acts as the backbone, overseeing the smooth operation of transactions between depository institutions. These institutions, such as banks and credit unions, rely on the Federal Reserve System to maintain stability and efficiency in the payment processing ecosystem.

One vital component of National Payment Processing is the automated clearinghouse (ACH), which enables electronic transfers between accounts. ACH serves as a reliable and cost-effective method for moving funds, offering a more streamlined alternative to traditional paper checks. By utilizing ACH, businesses, individuals, and financial institutions can securely process payments, improving overall financial operations. The reliability and speed of ACH transactions contribute significantly to the efficiency of the payment processing system, ensuring that funds are transferred accurately and promptly.

Entities in Payment Processing

Entities in payment processing, such as merchants, payment networks, and banks, play crucial roles in ensuring smooth transactions.

Payment processors act as intermediaries, safeguarding sensitive data and facilitating secure payments.

Technologies in payment processing continue to evolve, enhancing efficiency and expanding options for businesses and consumers alike.

Payment Processor Roles

In payment processing, various entities fulfill distinct roles to facilitate seamless transactions between merchants, customers, issuing banks, acquiring banks, and payment networks. Payment processors play a vital role in ensuring the efficiency and security of transactions. Here are some key points about payment processor roles:

- Payment processors act as intermediaries in credit card transactions, coordinating between multiple parties involved.

- They adhere to interchange fees and transaction standards set by major credit card networks like Amex, Discover, Visa, and Mastercard.

- Payment processors are responsible for batch processing credit card transactions, requesting funds from issuing banks, and settling payments into merchant bank accounts within 1-5 business days.

Understanding these roles helps ensure smooth payment processing and successful transactions.

Transaction Security Measures

Implementing robust transaction security measures is essential for ensuring the protection of sensitive payment data within the realm of payment processing. Encryption plays a critical role in safeguarding information during transactions, with entities like banks, processors, and networks utilizing technologies such as Secure Socket Layer (SSL) and Transport Layer Security (TLS) protocols.

Additionally, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for all entities handling cardholder data, ensuring adherence to strict security requirements. Tokenization further enhances security by replacing card details with unique tokens, especially in online transactions.

To combat security issues effectively, multi-factor authentication and advanced fraud detection systems are employed to prevent unauthorized access and fraudulent activities, maintaining the integrity of the payment processing ecosystem.

Payment Processing Technologies

Transitioning from the focus on transaction security measures, we now shift our attention to the realm of payment processing technologies, which encompass various key entities essential for facilitating secure and efficient payment transactions.

- Payment processing companies: These entities specialize in handling the processing of transactions on behalf of merchants, ensuring seamless payment flows.

- Payment gateway: Acting as a secure bridge between merchants and banks, payment gateways enable the transmission of payment data in a protected manner.

- Debit cards: Widely used for making electronic payments, debit cards are linked directly to the cardholder's bank account, allowing for convenient and swift transactions.

Understanding these entities is crucial for businesses and consumers looking to navigate the landscape of payment processing effectively.

Credit Card Networks

Credit card networks, such as American Express, Discover, Visa, and Mastercard, play a crucial role in the payment processing ecosystem. These networks are responsible for setting interchange fees and establishing transaction standards.

Understanding the importance of these networks and the transaction authorization process is key to comprehending the intricacies of credit card payments.

Network Importance

Joining credit card networks like Visa, Mastercard, Amex, and Discover is crucial for businesses looking to accept card payments efficiently and securely. These networks play a vital role in the payment processing system, ensuring seamless transactions and security for both merchants and customers. To understand the importance of these networks further, consider the following:

- Interchange Fees: Networks set interchange fees, which are charges between banks for accepting card-based transactions.

- Security Standards: Networks establish standards for card security, data transmission, and payment processing, ensuring a safe environment for transactions.

- Merchant Connectivity: Merchants need to be connected to these networks through acquiring banks to accept credit card payments efficiently.

Transaction Authorization Process

Upon making a purchase, merchants send transaction details to credit card networks like Visa and Mastercard for swift authorization processing. These credit card networks work with the issuing bank to verify the transaction's legitimacy and the availability of funds. Once confirmed, authorization codes are promptly generated by the network, either approving or declining the transaction.

This meticulous process ensures that only valid transactions go through, enhancing security and preventing fraud. Thanks to the efficiency of credit card networks, this authorization procedure occurs in just seconds, providing a seamless and secure experience for both merchants and consumers.

The use of authorization codes adds an extra layer of protection, guaranteeing that each transaction is carefully validated before being finalized.

Interchange Fees

Understanding the intricacies of interchange fees is essential for businesses looking to optimize their payment processing expenses. Interchange fees, which are set by payment networks such as Visa and Mastercard, play a significant role in determining the overall cost of processing transactions. These fees are paid by merchants to the card-issuing banks for their services in facilitating secure and efficient payment transactions.

To gain a better grasp of interchange fees, consider the following:

- Payment Network Influence: These networks establish the interchange fees, impacting how much merchants pay for each transaction.

- Merchant Cost Management: Understanding the factors influencing interchange fees helps businesses assess and control their payment processing costs effectively.

- Negotiation Opportunities: Armed with knowledge about interchange fees, businesses can leverage this information during discussions with payment processors to secure more favorable terms and rates.

Credit Card Processors Role

Credit card processors serve as vital intermediaries in the intricate web of transactions between merchants, customers, issuing banks, acquiring banks, and payment networks. They facilitate the smooth flow of funds during credit card transactions, ensuring that payments are securely processed and settled. These processors play a crucial role in the financial ecosystem, connecting various stakeholders to enable seamless payment processing.

To gain a clearer understanding of the functions performed by credit card processors, let's delve into a table that highlights their key roles:

| Key Roles of Credit Card Processors |

|---|

| Facilitating transactions between merchants, customers, and banks |

| Managing interchange fees set by payment networks |

| Determining transaction fees based on interchange rates |

| Ensuring secure and efficient credit card transactions |

Fees and Pricing Models

Credit card processing fees can vary based on factors like transaction volume and card type, typically ranging from 1.5% to 3.5%.

Debit card transactions are usually cheaper to process due to lower interchange fees.

Understanding fee structures and transparent pricing options is vital for merchants navigating the payment processing landscape.

Fee Structures

When selecting a credit card processing company, it's essential to carefully consider the various fee structures and pricing models available to ensure cost-effectiveness for your business. Understanding credit card processing fees, the interchange-plus pricing model, and surcharging programs can help in making informed decisions.

- Credit card processing fees: Typically range from 1.5% to 3.5% per transaction, with debit transactions usually being cheaper.

- Interchange-plus pricing model: Offers transparency by separating interchange fees from processor markups.

- Surcharging programs: Allow merchants to pass on processing fees to customers who choose to pay with credit cards.

Being aware of these aspects will aid in maximizing your business profits while maintaining financial control.

Transparent Pricing Options

To better understand transparent pricing options in credit card processing, we must delve into the various fee structures and pricing models available. Credit card processing fees typically range from 1.5% to 3.5% per transaction, with debit transactions usually cheaper than credit transactions. The interchange-plus pricing model is common, offering transparent fees based on interchange rates set by payment networks. Some processors provide surcharging programs, passing on processing fees to customers making credit card payments. It's essential to be aware of one-time or monthly fees that may apply, in addition to transaction fees, impacting overall processing costs. Understanding these different pricing models and fee structures is crucial when selecting a credit card processing company to ensure cost-effectiveness.

| Fee Type | Description | Example |

|---|---|---|

| Transaction Fee | A fee charged for each credit card transaction processed. | $0.30 per transaction |

| Interchange-Plus Pricing | Transparent pricing model where interchange rates are passed through to the merchant with added fees. | Interchange rate + 0.5% |

| Surcharging Program | Program allowing merchants to pass credit card processing fees to customers by adding a surcharge to credit card transactions. | 3% surcharge on payments |

Timing of Payments

Exploring the various timeframes for payment processing reveals the flexibility and efficiency offered by different settlement options. When considering the timing of payments, it's crucial to select the most suitable option based on your specific needs.

Here are some key points to keep in mind:

- Real-time payments: Immediate transfer of funds enhances liquidity and cash flow management, ensuring instant availability of funds for utilization.

- Same-day ACH transfers: These enable faster transactions, typically settling within a few hours, providing a balance between speed and convenience.

- Next-day settlement: Offers quicker access to funds compared to traditional settlement times, allowing for efficient cash flow management and quicker availability of funds.

Understanding the timing of payments empowers businesses to make informed decisions regarding their financial transactions, ensuring optimal control and efficiency in managing their payment processes.

Settlements and Funding Options

Settlements in national payment processing involve the efficient transfer of funds from the issuing bank to the merchant's account. When considering funding options, it's important to note that settlements typically take 1-5 business days to process within the payment system. For those seeking quicker access to funds, next-day funding options may be available, albeit often for an additional fee.

The process of settlement includes batching credit card transactions to ensure efficient processing. Once settled, payments are deposited into the merchant's designated bank account for easy access to the transferred funds. Understanding the various funding options offered by the issuing bank is crucial for managing cash flow effectively.

National Payment Systems Definition

In understanding the operations of National Payment Systems, it becomes evident that these systems play a critical role in facilitating financial transfers within a country's financial framework.

National Payment Systems (NPS) encompass the institutions and technology utilized for financial transfers, ensuring the smooth flow of funds between individuals, businesses, and financial institutions. The oversight of NPS by central banks guarantees the integrity of transactions, contributing to overall financial stability within a nation.

The infrastructure of NPS supports a wide range of transactions, from large-scale interbank transfers to everyday retail purchases made using credit cards. NPS also serve as a vital link connecting a country's financial activities to the global economy, enabling seamless financial interactions between different regions.

The messaging and routing systems within NPS facilitate secure communication between banks and other financial entities, ensuring that transactions are processed efficiently and accurately.

Regulatory Framework

The oversight of regulatory bodies ensures the efficiency and security of national payment system operations. The Federal Reserve plays a crucial role in supervising payment system operations to uphold efficiency and security standards. Additionally, the Office of the Comptroller of the Currency (OCC) regulates national banks involved in the payment system to ensure compliance with established guidelines. Furthermore, the Financial Crimes Enforcement Network (FinCEN) focuses on combating money laundering activities within the national payment system, enhancing its integrity.

Consumer protection laws are enforced by regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) to safeguard users in payment transactions. These laws aim to protect consumers from fraudulent practices, ensuring a fair and secure payment environment. Moreover, the Federal Deposit Insurance Corporation (FDIC) plays a vital role in maintaining the safety of banks and fostering consumer confidence in the payment system. By upholding regulatory standards and enforcing compliance, these entities collectively contribute to the smooth operation of national payment processes.

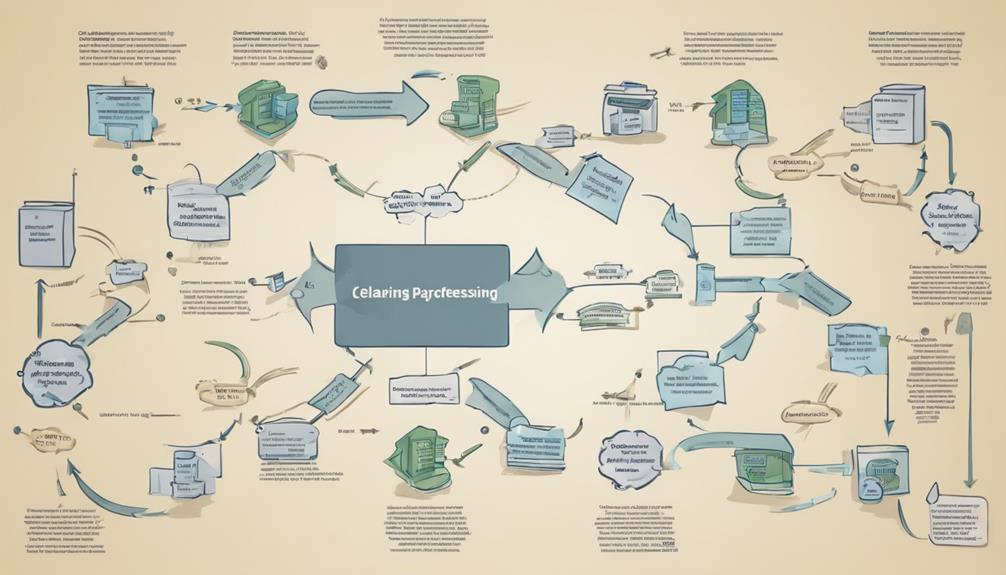

Clearing and Settlement Process

Regulatory bodies ensure the efficiency and security of national payment system operations; now, let's address the intricate process of clearing and settlement within this system.

Clearing reconciles payment orders, aligning them with final settlement positions to ensure accuracy. Settlement, on the other hand, involves the actual debiting and crediting of accounts to solidify transactions within the payment system.

To delve deeper into this process, consider the following:

- Retail Systems: Catering to everyday transactions, these systems handle smaller value payments efficiently.

- Large Value Systems: Designed for high-value transactions, ensuring secure and timely settlement of significant amounts.

- Securities Systems: Specialized systems for securities transactions, offering unique clearing and settlement services tailored to this specific market.

Understanding the distinctions between these systems is crucial for a comprehensive grasp of the clearing and settlement processes in the national payment system.

Importance in Economy

Facilitating commerce, financial inclusion, and economic stability, National Payment Processing is a vital component of the economy. Payment service providers such as banks and fintech companies play a crucial role in ensuring the smooth functioning of financial transactions. Efficient processing of payments through National Payment Systems (NPS) reduces transaction costs, promotes efficient capital allocation, and fosters overall economic growth. These systems also support the objectives of central banks' monetary policies, ensuring stability in the financial sector.

To further comprehend the significance of National Payment Processing in the economy, let's delve into the following table:

| Importance in Economy | |

|---|---|

| Financial Inclusion | Economic Stability |

| Efficient Processing | Capital Allocation |

| Central Bank Support |

Frequently Asked Questions

What Are the Stages of Payment Processing?

We initiate payment by inserting or swiping cards. Data is securely processed through terminals, then relayed for approval. Transactions are approved or denied based on funds and security. Once approved, funds transfer to settle transactions.

How Does the Payment Process Work?

We collect customer info, process it through terminals, secure data, get approval/denial, and transfer funds. Gateways, accounts, and processing firms help with smooth transactions. Payments happen in various ways like cards, wallets, and transfers.

What Are the Steps in Payment Process?

We glide through the payment process like a well-oiled machine. Customers initiate, terminals process, data securely flows, approvals happen, and funds transfer seamlessly. Each step ensures smooth transactions. It's a symphony of efficiency.

What Is the Flow of Payment Process?

In the flow of the payment process, customers initiate transactions, cards are processed, data is relayed securely, transactions are approved or denied, and funds are transferred. Multiple entities like merchant accounts and banks are involved.

Are the Payment Processing Systems for CBD Businesses Different from National Payment Processing Systems?

Yes, the payment processing systems for CBD businesses are different from national payment processing systems. Many national payment processors do not support CBD transactions due to the legal uncertainty surrounding the industry. It is important for CBD businesses to find a reliable cbd payment processing guide to navigate this unique challenge.

Conclusion

As we delve deeper into the intricate world of national payment processing, we uncover a complex web of interconnected systems and entities that drive the economy forward.

Just like the intricate dance of a well-oiled machine, each component plays a crucial role in ensuring seamless transactions and financial stability.

Understanding the nuances of payment processing is akin to deciphering a hidden code that unlocks the flow of commerce and fuels economic growth.